Clarity in 2017 is an elusive goal.

Heading into the final month of 2016, it’s been quite an unpredictable year.

The year started with a very unconventional primary season and election in the U.S., the UK voted to leave the EU, the Cubs won the World Series, and the Beavers ended an eight-year losing streak to win the Civil War against the Ducks.

Adding another surprise to 2016 has been the strength in the stock market since the U.S. election. There was great concern heading toward November 8 regarding potential outcomes as well as uncertainties about which policies were to be enacted. With the surprising win of Donald Trump and the Republicans retaining their majority in the House and Senate, investors immediately pivoted. Although uncertainty is still in play, investors and companies may be feeling some certainty on tax issues.

Investors immediately viewed the Republican sweep as a catalyst for major corporate tax reform as well as the possibility of significant infrastructure spending. This view resulted in a major shift in overall asset allocation, as well as sector allocation. Bonds sold off over 2 percent, pushing the yield on the 10-year Treasury from 1.85 percent to over 2.30 percent.

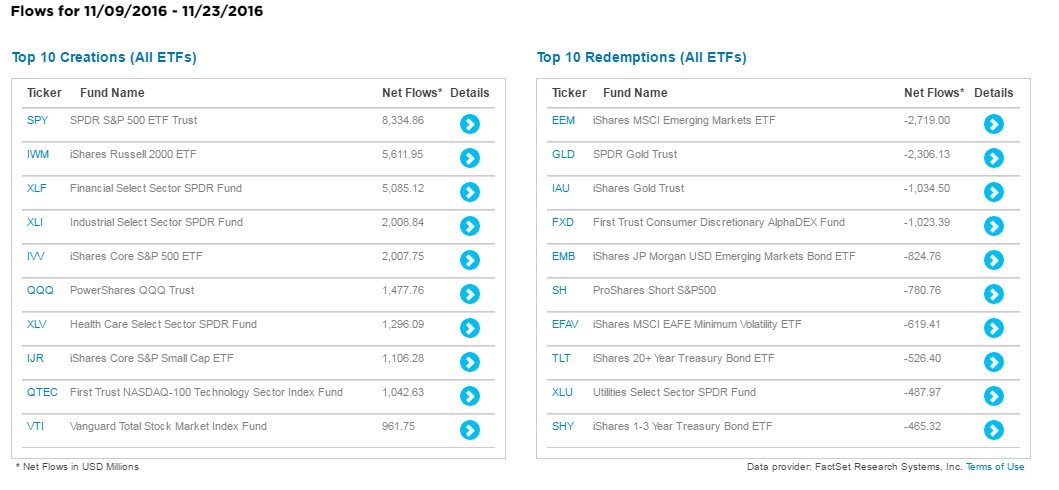

These higher yields pushed down interest-sensitive sectors, such as utilities and real estate investment trusts. The beneficiaries of this shift have been the financials sector, which is up over 15 percent post-election. The popular financials exchange traded fund (ETF) pulled in over $5.0 billion in new assets since the election.

Along with financials, the industrials sector was a beneficiary due to the view of increased infrastructure spending. The table below from ETF.com highlights the funds flows into and out of major ETFs. The obvious conclusion is that investors were caught short of equities and had to chase and did this by selling emerging markets and bonds.

We continue to be constructive on U.S. equities and view the potential reduction in taxes as a positive. We are currently evaluating our view financials since they are primarily U.S.-centric and lower U.S. taxes could be a huge benefit, albeit the move in rates is a wild card since higher rates aren’t necessarily a positive.

Bank profitability improves as the yield curve steepens. While this has occurred the last several weeks, we still expect the Federal Reserve to tighten in December, which will flatten the curve. We think the jury is still out on the banks, especially after the bounce we saw in November. Finally, on infrastructure, we aren’t as positive as the market. While we believe that the U.S. could use a major infrastructure initiative, we are less optimistic about major deficit spending making through a Republican-controlled Congress.

Now that we are past the election and on to holiday spending, it will be interesting to see if U.S. consumers are in the spirit of opening their wallets. Black Friday shopping is becoming less of an overall indicator as more stores start offering deals prior to Thanksgiving and more sales occur online.

Brick-and-mortar retailers have increasingly started promotions earlier and this year we saw several close their doors on Thanksgiving. It is estimated that 25 percent of holiday sales will occur online, growing 16 percent from last year. This share of wallet is double of what we saw in 2013. Cyber Monday continues to grow in popularity; this has a meaningful effect specifically on Amazon as it will be roughly 2 percent of their total annual sales. So far this holiday season, the winner looks to be electronics. While it is too early to see what type of growth we will have this holiday season, initial data points look to point positive growth.

Should we just put a bow on it?

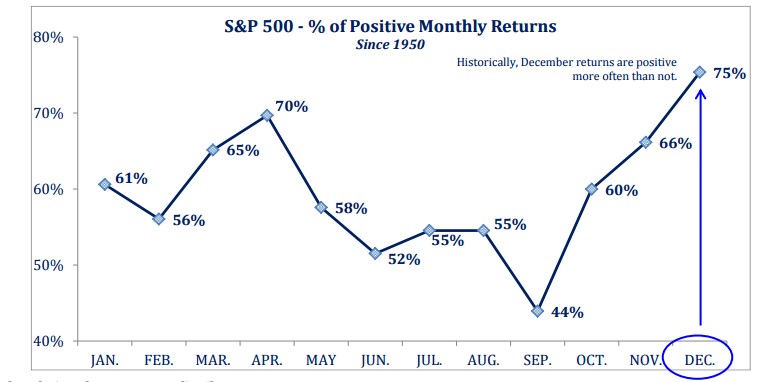

With the post-election rally resulting in a gain of over 10 percent for the S&P 500, should investors take profits or continue move money into equities. We view the market as fairly valued after recent strength and would not chase it at current levels. However, since investors had been underinvested in equities and the calendar looks favorable, we would not sell here. Below is chart from Strategas highlighting the percentage of time stocks are positive each month. As shown below, December has the best batting average with stocks rising 75 percent of the time.

We continue to remain optimistic on the capital markets as the year draws to a close. From there, our clarity on what the future holds may resemble a snow globe. Once shaken it may be unclear and then over time will settle into place.

Jason Norris, CFA, is executive vice president of research at Ferguson Wellman Capital Management. Ferguson Wellman is a guest blogger on the financial markets for Oregon Business.