The post-election Trump rally reflects “animal spirits,” in which instinct and emotion drive feelings about the economy.

As has been widely expected by market participants, the Federal Reserve raised the federal funds rate by 0.25 percent to 0.50 percent earlier this month. Short-term interest rates moved higher, and there was a slight uptick in longer-term rates.

The commentary out of the Fed highlighted the fact that the board now expects to increase rates three times in 2017, rather than two, and journalists were focused on this point when questioning Chair Yellen during her press conference. She downplayed the change, citing a small shift in economic expectations which moved the target. Regarding any potential fiscal stimulus in 2017, it seems the Fed is taking a “wait-and-see” approach.

We believe that the economy is on sound footing and will start seeing some modest inflationary pressures, especially in wages. As such, three rate hikes next year are reasonable.

In reality, this recent hike in the fed funds rate is the least of the bond market worries. We have seen a meaningful increase in longer-term interest rates since mid-July. Specifically, 10-year Treasury yields bottomed at 1.36 percent on July and have risen sharply to over 2.50 percent. While 2.50% is still low on a historical context, yields were roughly 2.25 percent one-year ago and this quick move upward will affect borrowing costs. Furthermore, it will have meaningfully negative impact for bond investors.

Smells Like “Animal Spirits”

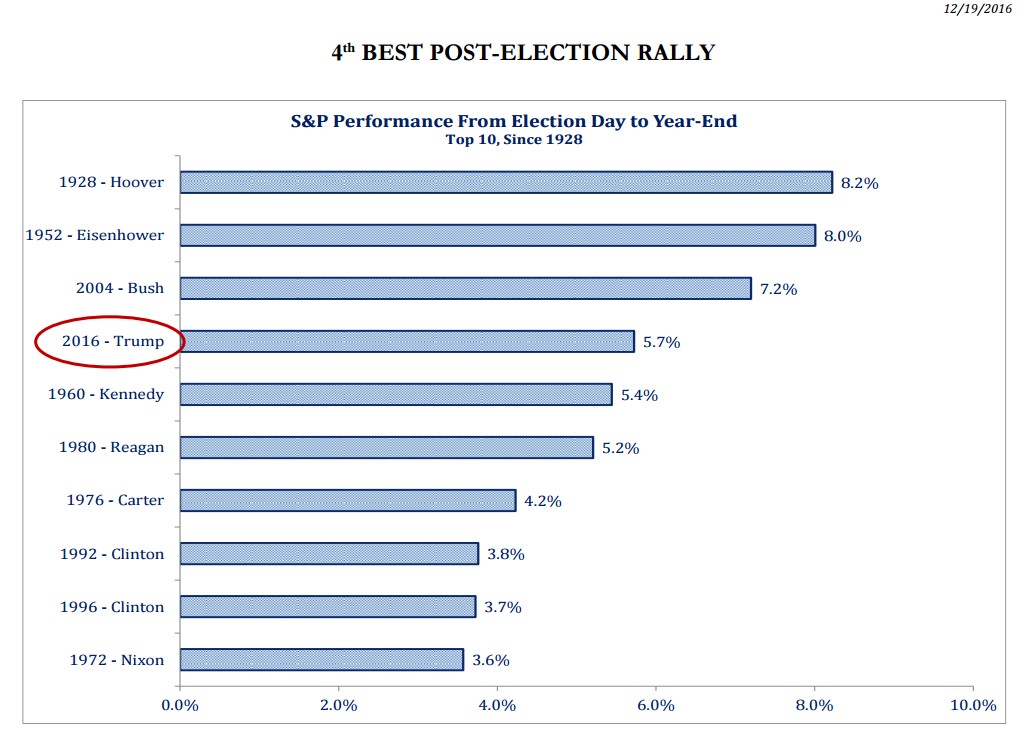

The financial media has been hyping the post-election Trump rally. While it is the fourth largest post-election rally in the last century, as indicated in the chart below, it’s the euphoria over the prospect of on lower taxes and increased fiscal spending that is feeding “animal spirits,” creating a “Nirvanian” view of the economy.

We are of the mindset that, while corporate tax reform and infrastructure spending is a positive for the U.S. economy, the magnitude of the effect will likely fall short of current expectations. Our sense is that any proposal will probably be revenue-neutral to the U.S. Treasury, thus having a muted impact in the short term. However, changes in the regulatory environment may lead to an uptick in business activity. Even with the recent strength in equities, investors may be negatively surprised when they get their December statements.

Through mid-December, U.S. stocks are up anywhere from 5 to 10 percent since September 30. Unfortunately, most investors don’t own just U.S. stocks. With the increase in interest rates, we have seen a selloff in both bonds and international equities. Bond returns over the same period are down 4 to 5 percent and international stocks are down over 2 percent. Therefore, global diversified balanced accounts will have returns closer to 1 percent over the same period.

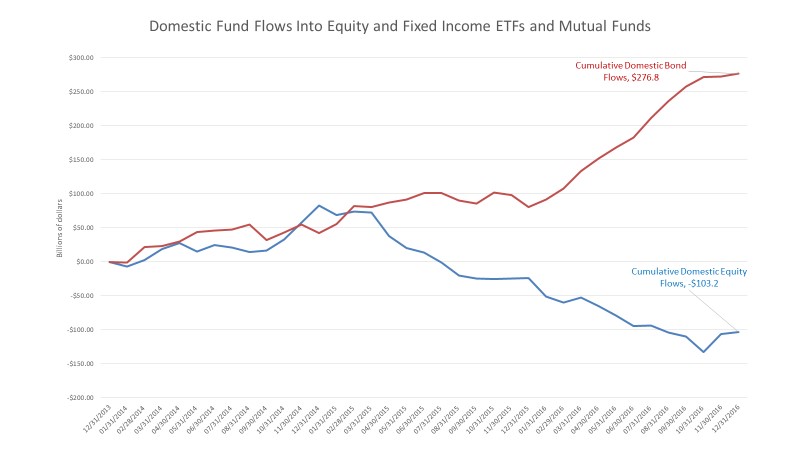

What may be even more of a sticker shock is that this return assumes an asset allocation of approximately 50 percent U.S. equities. The chart below highlights that individual investors have been selling U.S. stocks and adding to bonds for many years and are therefore underallocated to stocks.

Over the last three years, investors added just under $300 billion to domestic bond mutual funds and ETFs while selling over $100 billion in domestic equity mutual funds and ETFs. It wasn’t until November that we saw a major uptick in money going back into stocks, missing market returns of 29 percent over this timeframe.

The Coin Flip: From the global economy to what’s happening here in Oregon

What are “animal spirits?” Economist John Maynard Keynes coined the term in the 1930s with respect to human emotion driving behavior and confidence. If businesses “feel” better, are they willing to invest or spend money, thus improving economy. We have already seen some “animal spirits” in recent consumer confidence data and small business sentiment. While there is an improvement in “feelings” in the business environment, time will tell if emotion turns into action with increased spending in in 2017.

In that same “spirit,” overall alcohol sales are often resilient to any changes in the economy; however, we do see shifts in what people imbibe. For example, according to the Distilled Spirits Council of the United States, top-shelf liquor brands rose 8.9 percent as the economy improved from 2009 to 2010.

Conversely, when unemployment was heading toward 10 percent nationally in 2009, the $9-to-$12 bottle was the fastest growing segment in the wine market. With Oregon offering a wide range of price points for any wine drinker, we hope our regional fruit-of-the-vine will grow regardless of consumer sentiment toward the economy.

Jason Norris, CFA, is executive vice president of research at Ferguson Wellman Capital Management. Ferguson Wellman is a guest blogger on the financial markets for Oregon Business.