Share this article! China, oil, the Fed, U.S. recession … the headlines for the first few weeks of 2016 haven’t given investors any complacency. While investing isn’t always for the faint of heart, this year certainly has proven that adage. In this piece, we will briefly address some of the headline concerns and put 2016’s … Read more

China, oil, the Fed, U.S. recession … the headlines for the first few weeks of 2016 haven’t given investors any complacency. While investing isn’t always for the faint of heart, this year certainly has proven that adage. In this piece, we will briefly address some of the headline concerns and put 2016’s volatility in perspective.

2016 started off with a bang, as China announced a devaluation of its currency versus the U.S. dollar. This sent shock waves into the market, as it did in August of 2015, due to concerns of a slowdown in China. The cause of this weakness is a result of China moving away from linking their currency to the U.S. dollar and transitioning to a basket of currencies of major trading partners. This link has been somewhat stable over the last year; the weakness versus the U.S. dollar is due to this pegging to other global currencies weakening against the U.S. dollar. We do not anticipate a major devaluation in China and believe growth will continue to be in the 4-to-5 percent range.

On the surface, one would conclude that low oil prices are good for the economy, not bad. However, investors fear the low prices are a signal of slowing demand. We believe the contrary; that low oil prices are due to an abundance of supply, not a lack of demand. Global energy demand should continue to trend higher, and supplies should remain stable, thus leading to some upward price pressure in 2016.

The Federal Reserve has taken a slightly more dovish tone recently as global market volatility “may” affect consumer confidence and thus … economic growth. We applaud the Fed for emphasizing their “data-dependent nature” of decision making. Some market participants would like to see the Fed state that they won’t raise rates in March. We believe that would not be prudent; however, due to global uncertainty, we think a March rate hike is a long shot.

This view is based on our belief the U.S. economy is healthy. We do not believe we are headed into recession. On the contrary, the U.S. consumer remains strong. The unemployment rate fell below 5 percent and wages continue to trend higher. Debt levels have declined to pre-recession levels and the amount of income used to service that debt is at its lowest level since 1982. If that weren’t enough good news, the savings rate has steadily increased to close to 6 percent. While there has been some concern over the sustainability of this improvement, we see the glass half full. This view was supported by the most recent retail sales data. The January report showed a 3.7 percent increase in core retail sales (excluding energy and autos). Low gas price savings may finally start showing their way into the economy, rather than in consumer savings accounts.

These concerns, coupled with others, have resulted in higher-than-average volatility in equities.

A New Day Yesterday

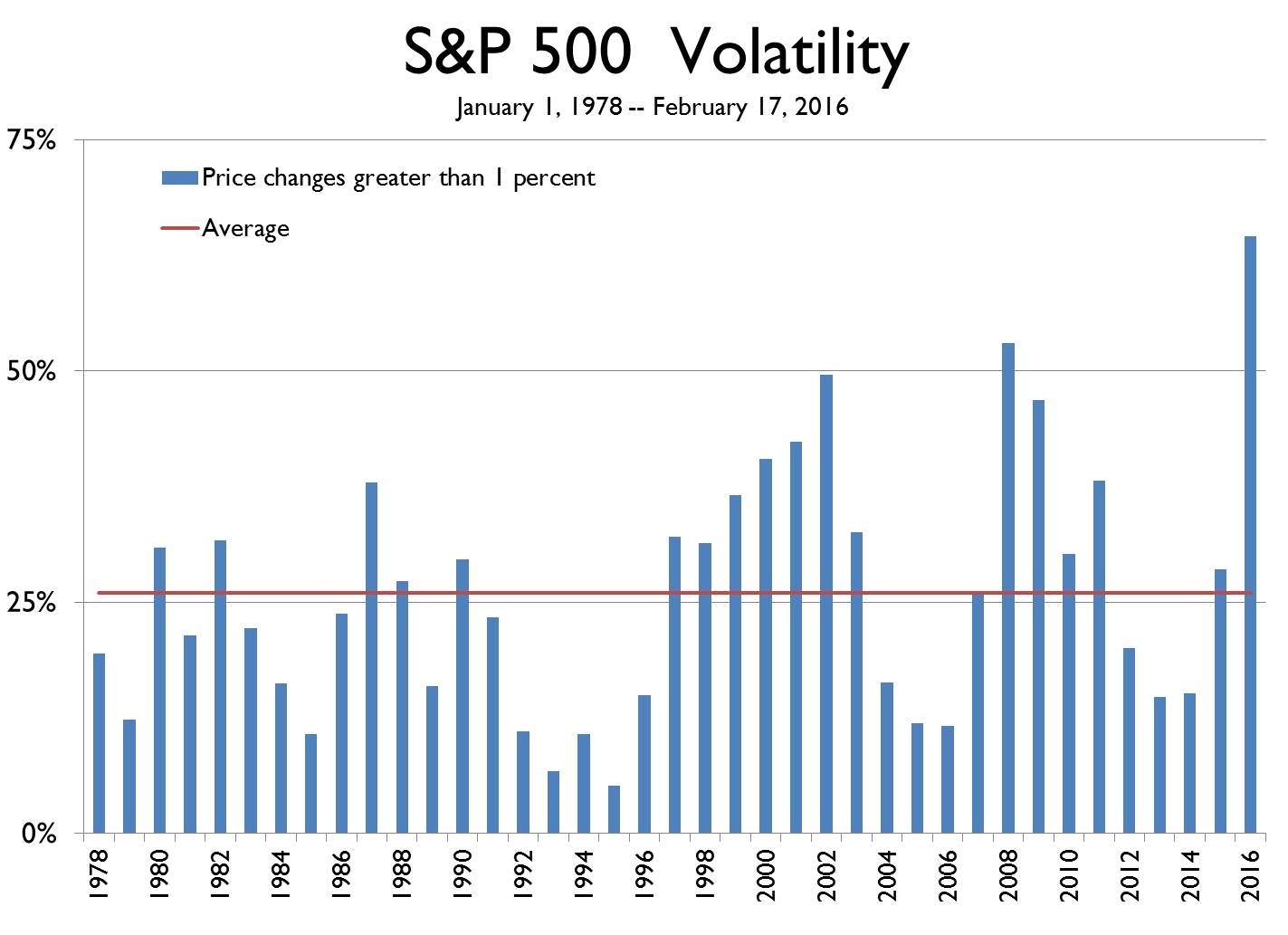

With U.S. large-cap stocks down close to 10 percent, it hasn’t been a Happy New Year for investors. There have been numerous comparisons of 2016 to 2008 and 2009, implying that we are heading into a recession. While the volatility in the stock market may be similar, we believe the state of the economy is much better than several years ago. The chart below shows the percentage of trading days that the S&P 500 was up-or-down over 1 percent in a year. We chose 1 percent since that is roughly 150 to 200 points on the Dow Jones Industrial Average and usually grabs headlines.

In any given year, 25 percent of the trading days experience stocks that are up-or-down at least 1 percent. This year, the markets have exhibited record volatility in the first six weeks with over 60 percent of the trading days resulting in a close up-or-down of over 1 percent. This is greater than the volatility we saw in in the periods of 2008 to 2009, 2000 to 2002 and … 1987. We believe investors are uneasy about the volatility in part due to the relatively “stable” markets over the past several years. We haven’t seen day-to-day movements in stocks like we have in 2016 since 2011. There may have been a sense of complacency with investors and have to remind ourselves that equities are considered a risk asset.

Our belief is that we are more in-line with what we saw in 2011, not 2008. While there are concerns of a slowdown in global growth, we believe that we are not heading into a recession as stated earlier. The 2011 comparison is appropriate due to concerns of a “growth scare,” primarily in Europe. At that time, there were concerns over Portugal, Ireland, Italy, Greece and Spain (referred to affectionately as the “PIIGS”). The U.S. economy is in much better health today and we have seen improvement in most of the European economies since then as well.

The growth scare we see now is China. While China is slowing we believe growth will continue in a 4-to-5 percent range as the economy moves from an infrastructure-spending focus, to a consumer-spending focus, just like all developed economies. In comparison, 70 percent of the U.S. economy comprises household consumption and less than 20 percent is capital investment. Contrast that with China where 37 percent of their economy is household consumption and 46 percent is capital investment. This is not sustainable for a $10-trillion economy. Their transition will take time and we may see some dislocations. We still, however, believe that the Chinese economy will still grow.

Nothing Is Easy

When will the volatility subside? We don’t know. We do believe that stocks will end the year higher due to the current uncertainty, but it is hard to forecast when the trend will turn toward the positive. Therefore, for those investors with a long-term outlook, we would be accumulating positions in equities, although we can’t guarantee those positions will be profitable in the next few months.

Finally, these periods of equity market volatility usually don’t last the entire year and we would expect volatility to fall throughout the year as we get more clarity on China’s growth and continued healthy data from the U.S. economy.

The Coin Flip

From the global economy to what’s happening here in Oregon

Oregon’s economy continues to grow at levels greater than the U.S. as a whole. Recent data has shown that three of the top five growing states are in the Pacific Northwest region: Oregon, Washington and Idaho. However, while we have stated that the Chinese economy will continue to expand, the growth and spending is going to be on different items. Fewer commodities, more consumer products. Fortunately, most of Oregon’s exports to China are not commodity related. China makes up 22 percent of Oregon’s exports. Therefore, economic growth is key for Oregon’s growth. Most exports are in the technology space (approximately 30 percent); however, wheat ranks as our second highest export at 8 percent. Fortunately, wheat demand is based on household consumption and not infrastructure spending. Therefore, we do not believe that China’s economic transition will be a negative for Oregon.

Jason Norris, CFA, is executive vice president of research at Ferguson Wellman Capital Management. Ferguson Wellman is a guest blogger on the financial markets for Oregon Business.