BY JASON NORRIS

BY JASON NORRIS

Historically, when the leaves fall, so do the markets. This year, earnings, Europe, energy and Ebola have in common? Beyond alliteration, they are four factors that the investors are pointing to for this year’s seasonal volatility.

BY JASON NORRIS | OB GUEST BLOGGER

Each month for Oregon Business, we assess factors that are shaping current capital market activity—and what they mean to investors. Historically, when the leaves fall, so do the markets. This year, earnings, Europe, energy and Ebola have in common? Beyond alliteration, they are four factors that the investors are pointing to for this year’s seasonal volatility.

In these times, we ask ourselves: Are these events truly worth all this handwringing? While recent volatility prompted investors to seek shelter, our recommendation to clients this quarter is to stay the course. We believe that these issues are overblown as the U.S. economy continues to exhibit solid growth.

Earnings

Earnings in October have been pretty healthy. Economically cyclical names, such as GE, Honeywell, United Technology, and Tektronix, have reported results that were ahead of (lowered) expectations. In the technology space, IBM stood out as a big disappointment, but we believe this is company-specific situation rather than an indicator of the overall sector. We have been negative on IBM for over a year due to the poor quality of earnings they’ve reported in the last several quarters. Spending in technology should be healthy this quarter as a lot of corporate America has underinvested the last few years. Intel delivered solid results earlier in the month, and Apple rode the iPhone 6 wave with units and average selling prices that surpassed expectations. We believe that the U.S. economy and corporate America will exhibit healthy growth which will support the equity markets, specifically the U.S., for the remainder of 2014 and into 2015.

Europe

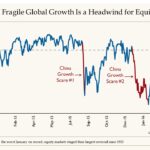

One of the fears of weak earnings is due to a slowdown in Europe. Economic growth on the continent is barely positive and Germany is teetering on dipping into recession due to a meaningful slowdown in manufacturing activity. This resulted in a precipitous fall in bond yields across Europe and a weakening of the Euro. German 10-year government bonds are now yielding under 1.0 percent and amazingly, even once “problem children” Spain and Italy are yielding less than 2.5 percent. To put in perspective, U.S. 10-year Treasury is currently yielding 2.25 percent. This race to the bottom has led to an underlying bid in the U.S. Treasury market, resulting in a strong dollar, which will present a headwind for large U.S. multinationals that export to Europe. This slowdown has prompted the European Central Bank to signal its willingness to purchase asset-backed and corporate bonds in order to stimulate growth and stave off deflation. While the earnings reporting period hasn’t shown much of an effect and many large industrials have signaled healthy growth into 2015—this risk remains a wildcard.

Energy

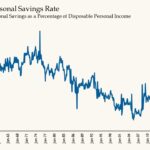

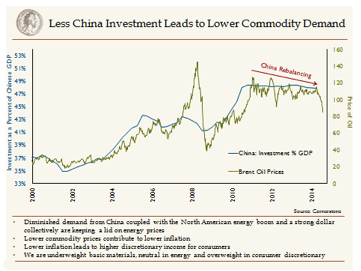

Adding support for the U.S. economy has been the rapid fall in the price of oil the last few months. Since mid-June, West Texas Intermediate (WTI) crude oil has fallen from $107 to the low $80s. This shift will result in a “tax cut” for U.S. consumers and businesses as every $0.01 reduction in gas prices frees up $1.2 billion to be spent elsewhere in the economy. With the U.S. being more of a player in supplying oil, OPEC has lost some of its sway in the markets. There was an expectation that Saudi Arabia would have reduced production to keep the price higher, but they have yet to do so. We believe that this is a structural shift in the market as the U.S. brings on more low cost supply, while global demand stabilizes as China shifts its economy from capital and investing, such as roads and bridges, to consumption. See chart below.

We have heard some concerns over how-low-can-the-price-of-oil-go before the U.S. curbs its own production. There isn’t a hard number, but there are some areas in the U.S. where the price can drop to $50 and still be economical. See table below.

Region | Cost per barrel |

Core Bakken | $45 – $55 |

Core EagleFord | $50 |

Permian | $60 – $80, though still falling with new completion techniques |

Ebola

So that leaves us with our last “E”—has Ebola affected the market and uncertainty? Our view is … possibly. Clients certainly have expressed concern about a breakout and its effect on the markets. Though there may be some industries, such as airlines and theme parks, that may experience disruption, overall, we believe it will be contained and not be a major market mover for the rest of 2014.

The Coin Flip

From the global economy to what’s happening here in Oregon

Forget about disruption from Ebola. According the Kaiser Permanente, the flu results in an $87 billion dollar economic burden due to lost work hours and visits to doctors and emergency rooms. Experts believe that many of these visits can be alleviated by having employees get the flu shot. Historically, getting the vaccine has reduced cases in the flu by six million per year, which frees up more hours for productivity, as well as smaller lines at the hospital or clinic. Our closing advice: flu shots are worth the investment.

Jason Norris, CFA, is executive vice president of research at Ferguson Wellman Capital Management. Ferguson Wellman is a guest blogger on the financial markets for Oregon Business.

BY JASON NORRIS

BY JASON NORRIS