A recent study by accounting giant Ernst & Young indicates that Oregon companies have little to complain about when it comes to their tax burden

A recent study by accounting giant Ernst & Young indicates that Oregon companies have little to complain about when it comes to their tax burden

STATEWIDE — A recent study by accounting giant Ernst & Young indicates that Oregon companies have little to complain about when it comes to their tax burden. In fact, the state ranks near the bottom when it comes to business’ overall share of state taxes.

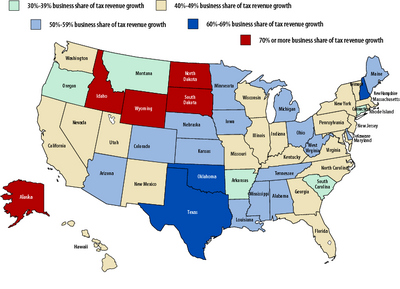

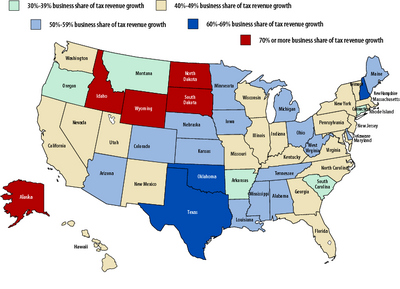

“It should make Oregon more attractive,” poses Tom Neubig, E&Y’s national director of quantitative economics and statistics. While the study found that, nationwide, businesses paid 48% of the entire increase in state and local taxes from 2002 to 2005, the business share of tax revenue growth in Oregon was just 36%. Businesses also escape a sales tax in Oregon which often collects as much as 40% from corporate purchases.

But Neubig also points out that while Oregon lets big business off relatively easy, sole proprieters and partnerships are hit by an emphasis on individual income tax, contributing 9% to the overall business tax burden compared to an average of 4% nationwide. “Not having a sales tax means there’s more taxes paid by households,” he says, “but it also falls on the owners of businesses.”

— Christina Williams

| State and local business taxes as a percentage of gross state product | |

| TOP FIVE | |

| Wyoming | 9.6% |

| Alaska | 9.3% |

| North Dakota | 6.6% |

| West Virginia | 6.6% |

| New Mexico | 6.3% |

| BOTTOM FIVE | |

| Delaware | 3.7% |

| North Carolina | 3.7% |

| Virginia | 3.7% |

| Oregon | 3.8% |

| Connecticut | 3.9% |

Have an opinion? [email protected]