Just because the economy has expanded for so long doesn’t necessarily mean a recession is on the way.

All good times must come to an end. That seemed to be the takeaway of a Deloitte study showing that 84% of CEOs think a downturn or recession will hit by 2020. Another alarming survey from the Wall Street Journal pegged the chance of it happening in 12 months at one in four.

Today’s economic expansion will break records this summer when it turns 10 years old. But that doesn’t mean a recession looms. We’re hard-wired not to expect something we’ve never seen before.

“Since no executive in the United States has experienced an expansion lasting longer than 10 years, they automatically assume a recession is near,” says Tim Duy, an economist at the University of Oregon.

Economists say they’re not seeing any signs of a recession yet, but that economic growth will likely slow over the next few years. Several prominent indicators of economic growth, including house, car and retail sales, dipped this month.

“The risks are elevated, but the next recession is not yet seen in the data,” says Josh Lehner, a state economist at the Oregon Office of Economic Analysis.

The lackluster statistics are likely temporary, Lehner says. The numbers should pick up in the next few months. Meanwhile, unemployment remains low, and wage growth shows an increase.

Duy, who publishes Fed Watch, a blog tracking the Federal Reserve, says the Fed’s move away from further interest rate hikes should help draw out the expansion. Interest rates are one of the primary tools the Fed uses to influence the economy. Raising interest rates can slow the economy down; slashing them can prolong economic growth.

“Since no executive in the United States has experienced an expansion lasting longer than 10 years, they automatically assume a recession is near,” says Tim Duy, an economist at the University of Oregon.

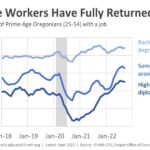

One thing for certain is that the the economic growth train is hitting the brakes. Job growth in Oregon has been slowing for two years. Combined with a fading fiscal stimulus at the national level, Lehner says, that makes it “no question” that we’ve moved past peak expansion. The effects of tax cuts are fading, and the trade war with China has taken a toll on businesses. The economy will show slower growth in 2019 than 2018, and even slower in 2020.

When that happens, Oregon could take a bigger hit than other states. The region has enjoyed strong growth during the expansion, largely on behalf of the robust tech sector in Portland. The richest economies tend to fall the hardest, says Mark Vitner, an economist at Wells Fargo.

“The guy going 90 on the highway is going to feel like he’s slowing down a lot more than a guy going 70,” Vitner says.

Whether that hints at a full-blown recession depends on whether you’re a glass-half-empty or half-full kind of person. In one of the best case scenarios ever seen, Australia is about to hit 28 years (and counting) of being recession-free.

Recessions only happen if a large event triggers them. If the economy cools off too much by 2020, the growth streak could be broken by a shock to another country’s financial system or a political turnaround.

“What makes me a little nervous about 2020 is the presidential election,” Vitner says. “There’s a lot of talk about economic policies that are extremely different.”

For now, cautious optimism seems warranted. A recession call can become a self-fulfilling prophecy if too many people believe it. Households tighten their belts, and firms cut back on investments and hiring, thinking the future will be grim.

Fortunately, the state’s economic experts are standing by their call of a slowdown, not a recession.

“The hard thing to determine is when growth slows somewhat more than was already expected, does that spell impending doom or not?” Lehner says. “For now the broad consensus seems to be it does not.”

Along those lines, Vitner says the Fed should hold off on toying with interest rates. He thinks rates will remain stable throughout the year, so the Fed doesn’t need to cut them yet.

Duy disagrees. The risk of a recession is real enough to justify action from the Fed, he writes on his blog. During two similar risky scenarios in the 1990s rate cuts saved the nation from a recession. The move would amount to an insurance policy against economic decline.

And insurance is cheaper than a crash.

To subscribe to Oregon Business, click here.