BY JASON NORRIS | OB CONTRIBUTOR

BY JASON NORRIS | OB CONTRIBUTOR

The implosion of the energy complex: The best thing for low oil prices is low oil prices.

The implosion of the energy complex:

The best thing for low oil prices is low oil prices

BY JASON NORRIS | OB CONTRIBUTOR

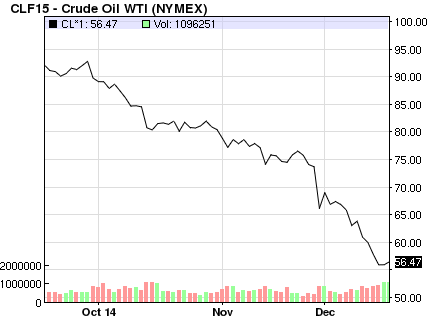

The price of crude in mid-June was $106; it currently rests in the mid-$50s. This major reduction should be a boon to U.S. consumers as gas, as well as other energy-intensive industries, are affected by lower prices. If oil prices were to stabilize at current levels, the U.S. economy may see close to $200 billion of spending moving outside of energy. This should stimulate other areas of the economy and continue lead to increased U.S. growth.

The 50 percent decline in oil prices has resulted in considerable consternation with investors and our clients. While slowing economic growth in China and Europe has been a factor in the fall, our belief is that it is more a result of supply, specifically in the U.S. global oil production is roughly 93 million barrels per day and historically OPEC has been the key factor in the marginal price by their manipulation of supply.

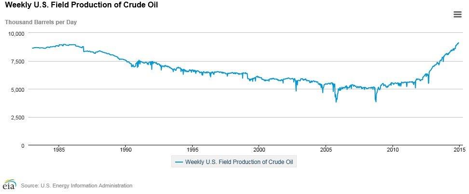

However, with the advent of improved technology in drilling, the U.S. has been able to bring meaningfully more energy to the market. In 2008, the U.S. produced 4.7 million barrels per day; the current production rate in the U.S. is 9.0 million barrels per day, as seen in the chart below, which makes America the third largest producer of oil in the world behind Saudi Arabia and Russia.

This production growth has allowed our economy to decrease its reliance on foreign oil, as well as the price swings that came from OPEC. Current annual imports from OPEC are roughly 12 billion barrels. In 2008 it was 20 billion. The energy renaissance across the country has resulted in lower inflation, increased jobs, better allocation of consumer spending and less reliance on OPEC. The Saudis could not have imagined a worse scenario.

Actually, it’s the Russians and Venezuelans that are really feeling the effects of the falling price. In the last year, imports of Venezuelan oil fell by over 100,000 barrels. Russia is feeling even more of the effect. With over 60 percent of their economy dependent on energy exports, the freefall in the price of oil may lead to another 1998-type meltdown.

The Russian stock market is down 60 percent since summer, with the ruble down by a comparable amount. As the currency weakens, all imports become meaningfully more expensive. Also, this instability in the currency has resulted in Apple no longer selling their products online to Russian customers.

One-year debt in Russia now yields over 12 percent, with comparable U.S. debt at 0.20 percent. Earlier this month, Russia hiked its short term interest rate from 10 to 17 percent to try to curb inflation and support its weakening currency. Only time will tell if we have a repeat of the defaults of 1998.

Sovereign nations aren’t the only debt issuers that are affected. The U.S. high-yield market consists of 16 percent exposure to energy companies. With falling oil prices, many of the major oil companies are reducing capital spending in 2015 because their projects are less profitable. If investors are looking at funds in the high-yield market for yield, they should make sure they take a look under the hood to see how much energy exposure the fund has.

In 2015, we do believe oil prices will stabilize as supply comes off line and demand remains healthy. We would expect a rebound for crude back up to $75 over the next 12 months.

Energy prices aren’t the only asset in freefall; we have seen a meaningful reduction in both U.S. and global interest rates. The U.S. 10-year Treasury yields are currently just over 2 percent. Yields like this would usually be the result of a pending recession or distortions in the market.

Last year, we saw that distortion with the Federal Reserve actively buying debt to keep rates low. However, as that process slowed, yields moved up to 3 percent by the end of 2013. Why have rates fallen 100 bps in 2014 with U.S. economic growth accelerating? Global pressures. When it comes to yields of developed nations, U.S. is meaningfully higher that the Eurozone and Japan due to their economic stagnation. Global fixed income investors can move into the U.S. and pick up close to an extra 1 percent in yield with “comparable” credit risk. This demand has led to a rally in the U.S. dollar as well.

Our view is that rates will eventually move higher as the U.S. Fed starts to raise rates due our improving economy and labor market. However, we do not anticipate seeing a major spike in oil prices; rather a halting of the decline due to a reduction of supply in the U.S. in 2015.

The Coin Flip

From the global economy to what’s happening here in Oregon

So, why don’t we pump our own gas here in Oregon? Our fair state and New Jersey are the only two in the nation who “outsource” this necessity for those who require gas for their transportation. This legislation was passed in 1951 due to the concern of citizens without adequate training interacting with flammable liquid.

Fast forward to 2014 – no doubt a visit to the pump has become more enjoyable and it’s not just because you get to stay in your warm car. Oregon’s average price plunged to 15 cents to $2.77, but that’s still 24 cents higher than the national average. Not to worry, we are still more than $1.00 lower than the peak price in 2014, which hopefully means more money for the holidays before prices will inevitably rise.

Jason Norris, CFA, is executive vice president of research at Ferguson Wellman Capital Management. Ferguson Wellman is a guest blogger on the financial markets for Oregon Business.

BY JASON NORRIS | OB CONTRIBUTOR

BY JASON NORRIS | OB CONTRIBUTOR