BY BRANDON SAWYER | OB RESEARCH EDITOR

Oregon prides itself on being a small-business state, but its moms-and-pops and start-ups are not feeling loved. According to a recent survey of small business owners, the state’s economy is worse off than the rest of the country.

BY BRANDON SAWYER | OB RESEARCH EDITOR

Oregon prides itself on being a small-business state, but its moms-and-pops and start-ups are not feeling loved. According to a recent survey of small business owners, the state’s economy is worse off than the rest of the country.

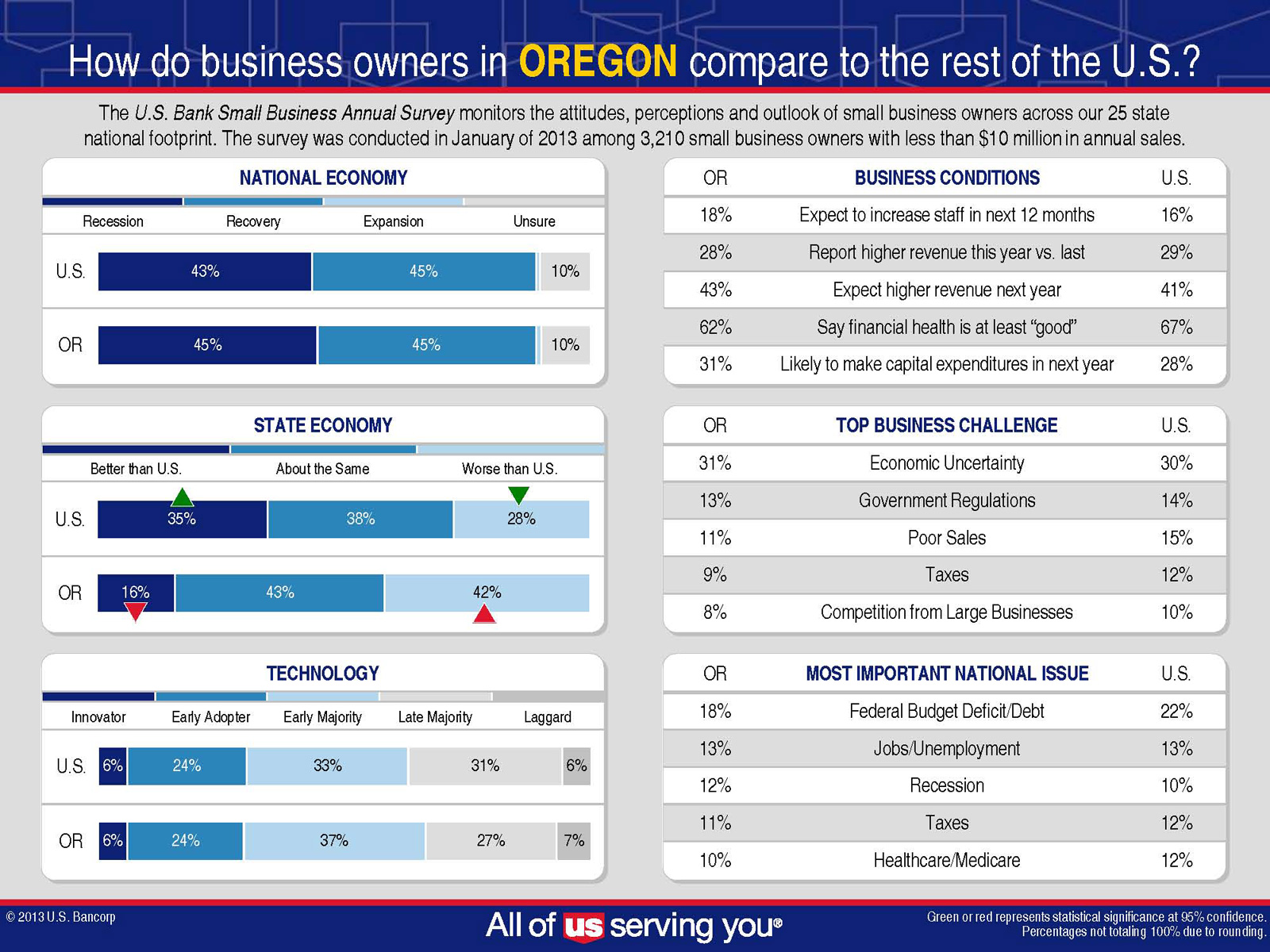

The 2013 U.S. Bank Small Business Annual Survey of more than 3,000 small business owners in 25 states, primarily in Midwest and West, found that 42% of the 200 Oregon owners polled felt that economic conditions were worse off here than the rest of the country. However, sentiment has actually improved in this, the survey’s fourth year: In 2011, 59% of Oregon owners felt the state was worse off than the nation.

In the other states surveyed for 2013 only 28% of respondents felt that their local economies were worse. And Oregon’s pessimism can’t be blamed on seaonal affective disorder, because only 24% of our northern neighbor, Washington’s, small business owners felt that way.

Only 16% in Oregon think the state’s better off, compared with 30% in Washington and 35% among all states surveyed. But whereas Washington’s business owners str significantly more pessimistic in 2013 than last year, Oregon’s owners are a little less depressed. Looking at the bigger picture, an equal number – 45% – thought the U.S. was in either a recession or in a recovery, and just 1% thought it was in expansion mode; 10% were unsure. These were roughly the same percentages for all those surveyed.

Oregon Business‘ reader input survey late last year found growing confidence in the state’s economy, with 42% of more than 500 readers expecting it to improve this year, and 48% of them expecting their own business to improve.

Top challenges cited by small business owners in the U.S. Bank survey are economic uncertainty, government regulations, poor sales, taxes and competition from larger businesses.

Among other queries, 18% of Oregon small businesses expected to hire in the next year; 28% reported higher revenue this year and 43% expect even higher revenue next year; 62% describe the health of their business as ‘good to excellent”; and 62% also say it’s difficult for their business to borrow money.

In releasing their survey results, Malia Wasson, president of U.S. Bank in Oregon and Southwest Washington, said small businesses across the country are still reluctant to hire or invest in capital expenditures. “They’re waiting for the economy to show more of a recovery before their confidence returns.”

// Graphic provided by U.S. Bank // Graphic provided by U.S. Bank |