Oregon’s top publicly traded stocks have not necessarily been valued for their quarterly performance of late. But Oregon Business research editor Brandon Sawyer runs the numbers and finds earnings rising at the largest companies.

Oregon’s top publicly traded stocks have not necessarily been valued for their quarterly performance of late. But Oregon Business research editor Brandon Sawyer runs the numbers and finds earnings rising at the largest companies.

BY BRANDON SAWYER, Oregon Business research editor

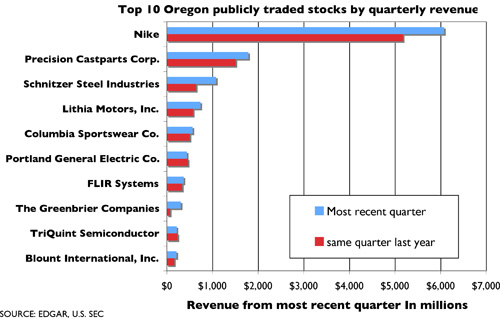

At the mercy of markets behaving like packs of lemmings, Oregon’s top publicly traded stocks have not necessarily been valued for their quarterly performance of late, but earnings rose in the most recent quarters for eight of the top 10 largest companies by revenue.

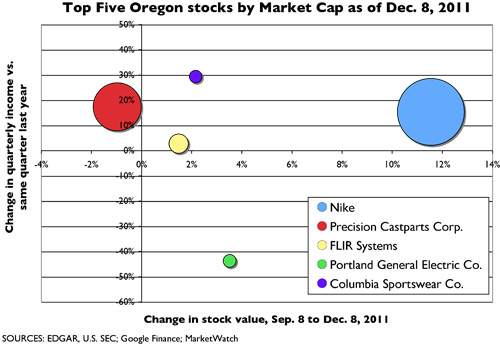

The value of Oregon’s largest by far in terms of market cap, Nike ($44.1b) sprinted ahead 11.5% over the past three months, assisted by a substantial 15.4% boost in quarterly net income and earnings per share (EPS) of $1.36.

While innumerable factors influence a company’s stock price, No. 2 Precision Castparts, on the other hand, received little acclaim for a 17.4% increase in net income and an even greater EPS of $2.03. Alone among the top five, its stock fell 1.0% during the last three months.

Meanwhile, stock of the utility Portland General Electric advanced 3.5% after its net income plummeted 43.8% and it generated an EPS of only $0.36.

Apparel retailer Columbia Sportswear had the largest increase in quarterly net income, 29.4%, with an EPS of $1.98, yet its stock gained a mere 2.2%.

Thermal imaging manufacturer FLIR Systems held the middle ground with a net income increase of 2.8% and a stock price gain of 1.5%.

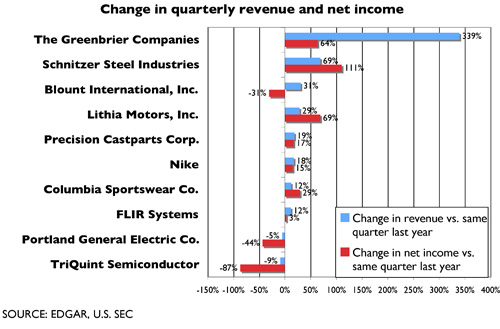

Nike and Precision Castparts also lead Oregon’s publicly traded companies for quarterly revenue. They and all but two – Portland General Electric and TriQuint Semiconductor – of the top 10 increased their revenue over the same quarter last year.

Of the top 10, railcar-manufacturer Greenbrier had the largest jump in quarterly revenue, 339.4% and a 63.9% net income increase. But Schnitzer Steel had the biggest rise in net income, 110.9%. Chainsaw-maker Blount had a 31.0% increase in revenue, third-best, but suffered a 30.8% drop in earnings, joining PGE and TriQuint for the three companies with lower net income compared to the same quarter last year.