Whether your business has an established plan for charitable giving or is just getting started, it is important to know how much of the philanthropic contributions your business makes can be deducted for tax purposes.

by Greg Chaillé, president, Oregon Community Foundation

Whether your business has an established plan for charitable giving or is just getting started, it is important to know how much of the philanthropic contributions your business makes can be deducted for tax purposes.

It can be daunting to navigate the complex tax structure for charitable giving. For instance, because the IRS treats business expenses differently from charitable contributions, it is essential that you are precise about the deductions you claim.

The following information applicable to Oregon businesses is based on contributions made to 501(c)(3) corporations and does not cover all types of charitable giving.

| Business Structure | Who Receives Deduction | Allowable Deduction |

| C corporation | Corporation | Up to 10% of a business’s pre-tax profit in the year of the donations. Contributions over 10% can be carried over for five years. |

| S corporation | Individual owner(s) | Up to 50% an of individual’s adjusted gross income in the year of the donations. There is usually a five-year carryover. |

| Partnership | Individual owners | Up to 50% of an individual’s adjusted gross income in the year of the donations. There is usually a five-year carryover. |

| Sole proprietorship | Individual owner | Up to 50% of an individual’s adjusted gross income in the year of the donations. There is usually a five-year carryover. |

The next chart summarizes IRS regulations for deductions. For greater detail on the regulations that are specifically applicable to Oregon and your organization or business, you must consult your tax adviser.

| Type of contribution | Charitable deductions | Business expenses |

| Direct cash donation | Yes. However, if you receive any benefit in return, you must subtract the value of that benefit from the amount of your deduction. | No. |

| Cash given to employees to donate to charities of their choice | Yes. | No. |

| Sponsorship | Yes, if not directly related to business. | Yes, if directly related to business. |

| Purchase of ad in nonprofit publication | Yes, if you don’t expect to earn at least the cost of the ad as a result of its publication. | Yes, if you expect to earn at least the cost of the ad as a result of its publication. |

| In-kind gifts of products | Yes, for the value of your costs, not market value. However, inventory donations by C corporations to benefit the ill, the needy or infants, and gifts of scientific equipment used for research may be eligible for higher-value deductions. | No. Be sure not to deduct your costs as both a business expense and a charitable contribution. |

| Depreciable property | Yes. Fair market value less prior depreciation. | No. |

| Stock | Yes, of both C and S corporations. Deductions can be made for fair market value if held by the donor for more than one year. | No. |

— Greg Chaillé, president, Oregon Community Foundation, www.ocfl.org.

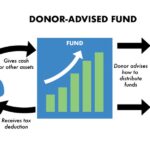

The Oregon Community Foundation offers advice on the tax benefits of setting up a business or family foundation and provides guidance for charitable giving.