Cornelius resident Christine Campbell followed 20 years of work in the mental health field with a stint in construction, working for a small building supply company, a construction firm and also one of the corporate behemoths of the industry.

Cornelius resident Christine Campbell followed 20 years of work in the mental health field with a stint in construction, working for a small building supply company, a construction firm and also one of the corporate behemoths of the industry.

homework

After 20 years in mental health, Cornelius resident Christine Campbell joined a growing small-business trend by launching her own tile-setting company last year. Photo by Michael G. Halle |

Home-based businesses are on the rise as more and more workers flee the corporate world.

By Jon Bell

Cornelius resident Christine Campbell followed 20 years of work in the mental health field with a stint in construction, working for a small building supply company, a construction firm and also one of the corporate behemoths of the industry.

But it didn’t take long before Campbell realized that the corporate gig didn’t exactly suit her fancy.

“It became almost like soldiers marching in a line,” she says. “It just wasn’t for me.”

So last year, armed with a natural knack for construction, some tools of the trade and her business partner, William Melgar, Campbell joined the growing ranks of Oregon’s small office/home office (SOHO) business owners by launching her own tile setting business, Tuscan Sun Tile & Stone.

“My business partner and I had a lot of experience with this kind of work in the past,” she says, “and we just decided it was time to combine our forces and see what we could do for the future.”

Campbell and Melgar are not alone. The SOHO business scene nationally and in Oregon, a state fueled by small business, is growing thanks to the Internet, globalization and shifts in the traditional workplace — and in spite of challenges such as shaky health care and retirement benefits.

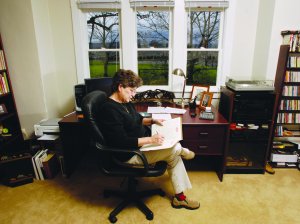

Christine Campbell tends to the books from her home office in Cornelius. Photo by Michael G. Halle |

According to the latest U.S. Census Bureau report on nonemployers — essentially self-employed individuals operating small, unincorporated businesses such as corner stores, home-based businesses or even weekend photography gigs — there were more than 20 million businesses without paid employees in 2005, an increase of more than 4% over the prior year. In Oregon, the Census counted some 218,000 nonemployer establishments with receipts of $9.1 billion in 2002; by 2005, those numbers had increased to more than 246,000 and $11.2 billion, respectively.

“I think over the years since I have been tracking this, there have been several moments when the SOHO opportunities have been on the rise,” says Terri Lonier, a New York-based small-business expert and founder of consulting firm Working Solo. “I think we’re currently in another one.”

In business for herself for more than 20 years, Lonier says the first big wave of SOHO opportunity came with the rise of the personal computer in the 1980s. After that, the Internet stoked the scene around 1995 and now, 12 years later, she says SOHOs are again raging thanks to “broadband ubiquity and the reality of actually having a global marketplace.”

Self-employment in Oregon has floated upward since taking a plunge during the recession in 2001. According to the Oregon Employment Department, some 167,000 Oregonians were self-employed in 2000, but by the next year, that number had fallen to 139,000. As the economy slowly climbed out of the slump, so, too, did self-employment numbers rise; by 2004, they were back up to 160,000.

“I can go to any community in Oregon and I can find people that, given the right resources, would be more than interested in starting a small business,” says Shawn Winkler-Rios, executive director of Lane MicroBusiness, a nonprofit micro-enterprise development organization in Eugene. Micro-enterprises are small businesses, often home-based, with fewer than five employees and capital needs of under $35,000.

| The rise of Oregon’s SOHO businesses | ||

| 2002 ESTABLISHMENTS | 2005 ESTABLISHMENTS | |

| Professional, scientific and technical services | 32,879 | 37,376 |

| Real estate and rental and leasing | 23,817 | 29,921 |

| Construction | 23,155 | 24,994 |

| Arts, entertainment and recreation | 11,960 | 14,184 |

| Mining | 145 | 148 |

| TOTAL | 218, 326 | 246,129 |

| SOURCE: U.S. Census Bureau | ||

The rising numbers of SOHO businesses can indeed be linked in part to the proliferation of high-speed Internet connections. In addition, unlike earlier generations, younger workers aren’t working for the same employer for their entire careers. Instead, they’re assembling what Lonier deems a “delightful mélange” of different work opportunities and skills, which often includes stints of self-employment.

But the SOHO has also become more appealing to the graying masses as well.

“We have an increasingly large number of baby boomers who are saying, ‘I may be leaving my job, but I’m not retiring,’” Lonier says.

And then there are economic factors that sometimes force people into self-employment. A prime example: last fall’s closure of Louisiana Pacific’s mill near Burns. Winkler-Rios says a few former employees have decided to have a go at their own business, and one even plans to use his severance pay for startup money.

Since he came on board in 2000, Winkler-Rios also has seen increasing support for the SOHO as an economic development tool, especially in rural areas. In 2000, there were just nine members of the Oregon Microenterprise Network, a statewide web of programs like Lane MicroBusiness; today there are more than 45. And where once Lane served businesses in just its own county, it now has projects in 11 counties.

“Oregon has a pretty vibrant microenterprise industry, and it’s growing,” Winkler-Rios says. “I think there’s been a shift in the smaller communities too and we’re starting to see more interest in home-grown businesses as an economic development strategy.”

But if the bigger picture may be rosy for Oregon SOHOs, often the day-to-day is full of the trials and tribulations of small-business owners. Among them: health care, cash flow, finding steady business and planning for the future.

“It’s very exciting and it’s full of possibilities,” says Paul Bingman, owner of a web programming company called Edgewood.net. “It’s also very scary at the same time.”

Natalie Brecher, a management consultant in Beaverton, has been in business for herself since 1998 and says that being the only one who performs her work — primarily speaking and consulting — she is limited in how much she can accomplish in a normal day. She also says sole practitioners often don’t have people around them to talk about ideas.

And, like any business, larger market forces also can have their ways with the self-employed. Bingman says the “dot-bomb” market crash was tough for him to weather, and Kathleen Cremonesi, who works for her husband’s Veneta-based espresso repair business, Steffano’s Espresso Care, says the strong euro has forced the company to up prices on parts imported from Italy.

But by far the most discomforting ache to small-business owners is health care. Without the resources of a large company, many SOHO businesses struggle with providing insurance not only for employees, but even for their owners.

A 2005 survey by the National Association for the Self-Employed found 14% of micro-business owners had no health insurance and 27% relied on their spouse’s coverage, a setup commonly referred to as the corporate/SOHO hybrid.

“It’s something we’re still working on,” says Cremonesi, who has yet to find good insurance for herself and her husband. “Health insurance is a challenge, and I don’t know that there are a lot of great options.”

Brecher says she has catastrophic insurance with a $5,000 deductible. Although fine for now, she says she is concerned with the continued increase in premiums and what will happen over the next 14 years until she’s eligible for Medicare.

Though he’s no longer married, Bingman had a corporate/SOHO hybrid setup when he originally set out on his own with his tech company. And Campbell, whose partner of 18 years works for an executive travel company that provides benefits to domestic partners, says she’d be at a loss without the coverage. “Without that we’d pretty much be up a creek,” she says.

Lane MicroBusiness is looking to model a partnership established in Colorado between Kaiser Permanente and 120 microenterprise programs that allows small business owners to acquire affordable coverage. Winkler-Rios says that the program still is a ways off, but he has hope, not only for a health-care solution for small businesses, but for a continued upward swing in the SOHO space as well.

“I don’t see myself running out of work anytime soon,” he says.

Have an opinion? E-mail [email protected]