Despite their far-flung locations, outlet malls are thriving in a down retail market.

Despite their far-flung locations, outlet malls are thriving in a down retail market.

Despite their far-flung locations, outlet malls are thriving in a down retail market.

BY JASON SHUFFLER

|

It’s nearly 10 a.m. on a late-summer workday and the vast parking lots of the outlet mall in Woodburn are filling up quickly. The line of shoppers and employees at the mall’s coffee shop continues to grow until, finally, the array of stores open their doors and people file in.

By midday the hum of shopping activity is getting louder, the traffic of people thicker. Kids play on a fort made just for them, while in the food area seniors eat burritos and women push strollers loaded with bags from OshKosh B’Gosh.

The Woodburn Company Stores outlet mall is more than just a place to buy stuff; it’s an upscale destination that mixes recreation, socializing and shopping. And there and at outlet malls across Oregon and the country cash registers are ringing while conventional shopping centers and stores struggle during a tough year. In 2007, Oregon outlet centers exceeded $350 million in total sales and employed more than 2,500 workers, according to industry estimates. They accounted for about 1.7% of total retail sales in Oregon.

People are wary of the economy and are spending more on food and fuel, leaving less money for retail goods. Competition for their leftover dollars is brutal, and the losers are closing shop at a rate analysts haven’t seen since 2004.

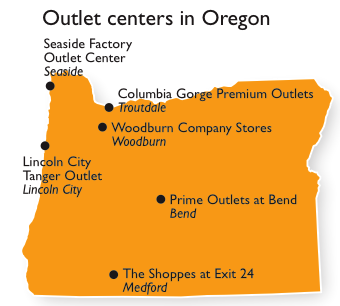

But if you’re a business wanting to lease a spot in an outlet mall, take a number. The Woodburn outlet is just one of six in Oregon, with the others located in Lincoln City, Seaside, Bend, Medford and Troutdale. Some are at full capacity and others are just near it. “The outlet industry is on the radar screen,” says Linda Humphers, editor-in-chief of Value Retail News (VRN), a magazine that covers the outlet mall industry.

For the outlet malls, their eyes are set on international shoppers, local tourists, moms shopping for back-to-school clothes,and good old-fashioned bargain hunters. Outlet malls throughout Oregon are reporting an increase in Canadians driving down for what they dub “shopping vacations.” The weak dollar and the boosted purchasing power of foreign currencies make the outlet malls all that more attractive, say retail experts. Foreign shoppers want the American goods that cost less to buy here, brands such as Nike shoes, Levi’s jeans and Calvin Klein underwear.

For the outlet malls, their eyes are set on international shoppers, local tourists, moms shopping for back-to-school clothes,and good old-fashioned bargain hunters. Outlet malls throughout Oregon are reporting an increase in Canadians driving down for what they dub “shopping vacations.” The weak dollar and the boosted purchasing power of foreign currencies make the outlet malls all that more attractive, say retail experts. Foreign shoppers want the American goods that cost less to buy here, brands such as Nike shoes, Levi’s jeans and Calvin Klein underwear.

Staci Miethe, general manager of Seaside Factory Outlet Center, estimates that this spring and summer 70% of business was from tourists. About 25 miles south of the Washington state border, a good chunk of the outlet mall’s annual 2 million visitors also come from out of state because there’s no sales tax in Oregon, she says.

Bigger groups of people also are popping up at the Lincoln City Tanger Outlet this year, suggesting visitors are carpooling and making a social trip out of it, says Diane Kusz, general manager of the outlet for 15 years. The mall is one of 33 owned by Tanger, the second-largest developer and owner of outlet malls in the nation. More than just a place to shop, “we have looked to be a destination,” says Kristy Kummer, marketing director at the outlet in Woodburn.

The first factory outlet malls were anything but a destination event, starting out as nothing more than a collage of boring stores with substandard merchandise and odd-sized clothes, built far from urban and downtown areas because of non-competes with conventional department stores. As factory outlet stores became more popular with bargain-hunting Americans, brands decided they needed to spruce up their image by offering betterquality stores.

Outlet malls are no longer the neglected stepchildren in the retail family with flawed goods and taste. Now they’re designed to be aesthetically appealing to shoppers and offer a greater variety of popular brands, an approach that is contributing to their quiet success, experts say. “Outlet malls are holding their own,” Humphers says.

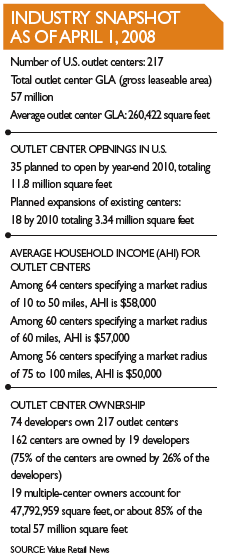

They’re getting bigger, too. In 1996, there were 329 outlet malls with an average size of 188,000 square feet. By 2007, the average size of a new center was 450,000 square feet, according to VRN. Woodburn’s outlet, which opened in 1999, is more than 300,000 square feet.

|

Developers see dollar signs and plan to go after them, planning 35 new centers nationwide by 2010. An additional 18 of the existing malls plan to expand their sites, according to VRN. At Woodburn, while shoppers stroll through walkways with stuffed bags from the Gap and Adidas, the sound of hammering is heard as construction crews erect an additional building to house seven more merchants, including J. Crew and Kenneth Cole, when it opens in early 2009.

While scarcer financing has halted the expansion plans for some industries, outlet developers secured money because they’re doing so well, says Chris Sherland, an analyst with the global valuation real estate firm Cushman & Wakefield. “They are a proven concept now,” he says.

The concept has not always been so successful. The whirlwind of outlet building through the 1980s and early ’90s outpaced a solid understanding of what consumers wanted. Smaller outlet malls failed because they were in unfortunate locations and didn’t have the right variety of brands shoppers wanted, says Sherland. It wasn’t worthwhile to do all that driving to shop at just one store. “Having the right tenant mix is important,” he says.

While many of the ones that closed were ill-conceived, others got bigger. And big is precisely what’s now the successful formula, says Sherland. The bigger and most successful outlet malls are one-stop shops, offering a greater diversity of luxury and popular brands. Sherland credits the Woodburn outlet as the first in the state to emphasize this. Outlets “have a healthy future in Oregon,” he says.

Humphers, who has covered the outlet mall industry for more than 20 years, says that in the past 10 years developers have been making wiser choices to build outlet malls in more populous areas than before.  Kusz, of the Tanger-owned Lincoln City outlet, says she gets calls every day from businesses wanting to lease space, but she’s constantly telling them the outlet is 100% full. Seaside’s outlet mall has no room for new tenants, either. According to the VRN, the average occupancy rate for the two biggest outlet-mall owners, Chelsea and Tanger, is above 96% nationally.

Kusz, of the Tanger-owned Lincoln City outlet, says she gets calls every day from businesses wanting to lease space, but she’s constantly telling them the outlet is 100% full. Seaside’s outlet mall has no room for new tenants, either. According to the VRN, the average occupancy rate for the two biggest outlet-mall owners, Chelsea and Tanger, is above 96% nationally.

Popular brands such as Portland-based Columbia Sportswear Company see outlet malls not just as another way to distribute their goods but as a savvy way to promote their company. “We think it’s more important to brand,” says Kerry Barnes, Columbia’s vice president of retailing. The company has 23 outlet stores in 19 states, three of them in Oregon, he says.

Part of what drives the bargains at outlet malls is the relatively cheap rent for tenants. At more conventional shopping centers, anchor stores like Macy’s and Nordstrom push up the rent for smaller to midsize tenants. Outlet rents can be up to 8% less than in a traditional mall. A VRN survey says shoppers get on average a 37% savings at outlet malls compared to traditional retail stores and malls.

Sales are direct so there’s no markup to drive up the cost of merchandise. At Columbia, overstock merchandise or goods that aren’t sold at its flagship store in downtown Portland are often discounted up to 25% at outlet locations, says Barnes. And one of those locations is the thriving Woodburn outlet.

By late afternoon at the Woodburn outlet, construction crews have vacated but the parking lot is packed. Josi Yett is sipping coffee with friends. She lives in Portland, about a 35-minute freeway drive away, and used to shop here more often, but gas prices have her staying closer to home. For her, the savings aren’t there anymore. “Why drive so far when the prices are comparable?” she says. She’s come to Woodburn just to meet friends, not to shop.

So far, soaring gas prices haven’t deterred people from making the trip, industry analysts say. For now, many shoppers are still drawn to the drumbeat of markdowns and irresistible bargains on top-brand merchandise all the outlet malls promise.

For most consumers, the “gas prices are negligible,” Humphers says. On average, it’s no more than two gallons of extra gas in the tank to get to one, she says.

The outlet industry takes the price of gas very seriously, though. But the fear of empty parking lots hasn’t yet come true. At Woodburn, more of its 4 million annual visitors are carpooling, says general manager Teri Sunderland. In the business formula of outlet centers, “gasoline prices are just one factor,” she says.

“We haven’t seen any clear-cut cause and effect [from gas prices],” says Michele Rothstein, senior vice president of marketing for Chelsea Property Group. The company owns and manages the most outlet malls worldwide, 38, including the Columbia Gorge Premium Outlets center in Troutdale. “The distance isn’t that great,” she says, staying in tune with the message that has served the industry well so far.

Sales at Chelsea’s outlet malls are up 5.5% from the second quarter of last year, according to a recently published Merrill Lynch report on the retail industry. “People are still spending,” says Rothstein, “it just depends on where they are spending.”

Have an opinion? E-mail [email protected]

The Columbia Gorge Premium Outlets in Troutdale is one of six outlet malls in Oregon.

The Columbia Gorge Premium Outlets in Troutdale is one of six outlet malls in Oregon.