JOBS OUTNUMBER RESIDENT workers in Hood River County because of a large agricultural base and summer and winter recreation.

JOBS OUTNUMBER RESIDENT workers in Hood River County because of a large agricultural base and summer and winter recreation.

JOBS OUTNUMBER RESIDENT workers in Hood River County because of a large agricultural base and summer and winter recreation. Seasonal migrants and workers from Washington fill many jobs.

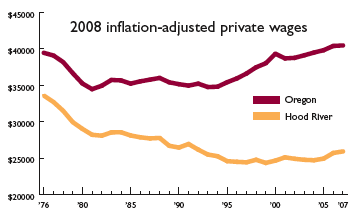

Average private-industry wages, based on place of work, reflect that reality, ranking it 32nd out of 36 counties. Department of Revenue tax statistics, based on place of residence, tell a different story. Hood River County’s

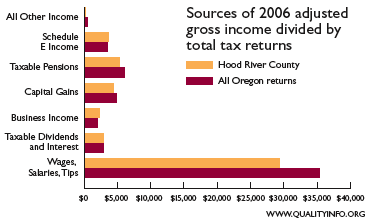

adjusted gross income (AGI) from all sources averaged $46,038 per 2006 tax return, good enough to rank it 13th. Wages and salaries are the bread and butter of every county’s AGI, but not every taxpayer draws a paycheck. The self-employed in particular escape the wage data compiled through Oregon’s Unemployment Insurance system.

These workers boost Hood River County’s average business income per tax return — which ranked 5th statewide — Schedule E income including S Corporations (8th), and taxable dividends and interest (9th). Low wages are a reflection of the county’s industry base, but they do not adequately represent Hood River County’s entrepreneurial spirit.

— DALLAS FRIDLEY

Worksource Oregon Employment Department

Have an opinion? E-mail [email protected]