In the 1980s, Turtle Island Foods blazed a trail in the manufacture of plant-based foods. Its CEO is now faced with the task of retaining market share in an increasingly competitive vegan-food market.

Jaime Athos wore a vegan leather belt and sunglasses as we strolled along the roof of the Turtle Island Foods factory in Hood River. The CEO of the vegan-food manufacturer showed off the company’s solar-panel array, installed as part of the building’s bid to be Leadership in Energy and Environmental Design (LEED) certified.

A former neurobiologist, Athos left the sciences after becoming frustrated by the stifling amount of careerism. A believer in the virtues of plant-based eating, Athos decided he could do better for the world by working for his stepfather, Seth Tibbott. A self-described hippie, Tibbott founded the company in 1980 out of a treehouse made of scrap lumber with only $2,500 to his name.

From those humble beginnings, Tibbott’s goal for the company was to make plant-based protein more popular in the U.S. Turtle Island Foods’ success came with the creation of Tofurky, a savory plant-based loaf, which is still popular at Thanksgiving.

In its early years, Tofurky was sold only at select health-food stores. But plant-based eating has seen an explosion of popularity since then. With 10 years of sustained growth, the privately held company now finds itself swept up in a plant-based revolution.

The Turtle Island Foods headquarters in Hood River. The company is better known by its brand name Tofurky. Photo: Jason E. Kaplan

The Turtle Island Foods headquarters in Hood River. The company is better known by its brand name Tofurky. Photo: Jason E. Kaplan

Since taking over as CEO in 2014, Athos has launched next-generation products in an attempt to attract younger consumers. He has also sought to break into emerging markets and fend off legal attacks on the plant-based food sector. His main challenge now is to remain competitive in an industry that has seen several successful entrants, such as Impossible Foods, the maker of the Impossible meat-tasting vegan burger.

“We were surprised how quickly plant-based eating caught on, but it has been gratifying because that was always the goal,” says Athos. “When we first started, a lot of our work revolved around educating vendors about who plant-based consumers were, and convincing them they would make money selling our products. Those days are long gone. This new mainstream acceptance means the Krogers and Walmarts of the world want to carry products like ours.”

Approximately 14% of American households purchase plant-based foods at least occasionally, according to a market report by the Good Food Institute. The industry has experienced double-digit growth every year since 2017.

No one reason can be attributed to the rise of plant-based eating. Early trailblazers like Turtle Island Foods — which makes a variety of vegan foods that mimic meat, such as Tofurky sausages — as well as the popularization of soy and almond milk likely contributed.

No one reason can be attributed to the rise of plant-based eating. Early trailblazers like Turtle Island Foods — which makes a variety of vegan foods that mimic meat, such as Tofurky sausages — as well as the popularization of soy and almond milk likely contributed.

A 2006 study by the United Nations found livestock emit more carbon dioxide than the world’s transportation sector, sounding alarm bells for climate-change activists. Popular books and documentaries like Forks Over Knives have also called attention to research showing animal products are less healthy than previously thought.

Another recent factor is the presence of next-generation protein products like the Beyond Burger that have a meaty flavor and texture comparable to animal protein. “You don’t have to suffer anymore to eat plant-based,” jokes Athos.

RELATED STORY: Are Vegans the New Cannabis?

The plant-based food revolution meant the Hood River company has avoided the downward trend in rural Oregon manufacturing. In 2016 Turtle Island Foods expanded its operation by building an additional 44,000-square-foot manufacturing facility.

Athos also sought to make the company B-Corp certified in an attempt, he says, to honor his stepfather’s vision of creating a company that is a force for good first and a business second.

After 2018 saw a 24% sales growth, the company accepted $7 million in private investment to meet growing demand for its products. Last year it inked a deal with Walmart to sell Tofurky products in 4,200 stores across the country.

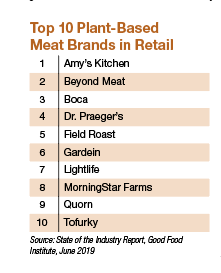

With only 220 employees, Tofurky occupies a smaller share of the market compared with some of the new players in the space. In terms of overall sales, Tofurky ranks 10th among plant-based meat manufacturers, behind companies like Gardein and Beyond Meat. Amy’s Kitchen occupies the No. 1 slot.

Athos downplays the stiff competition the company now faces in the vegan-food sector.

“I know it sounds like B.S., but we don’t see other plant-based companies as competitors. When you look at the animal-protein market, it has a huge variety of brands. There’s room for Tofurky and Beyond Meat and Impossible Foods. Stories about IPOs and the Impossible Whopper help everyone. For now, a rising tide lifts all boats.”

A multitude of meatless products at a Portland-area New Seasons include “Local Faves” Tofurky pockets.

In January Tofurky launched its own version of the plant-based burger in partnership with retailer Target. Although the new burger kept Tofurky on-trend, another plant-based meat product was not uncharted territory for the company.

With so many products luring carnivores away from animal protein, Athos decided the company could not affect change by simply riding the tide. If Turtle Island Foods was going to stay relevant, it would have to innovate.

RELATED STORY: The Vegan Old Guard Moves Seamlessly Into the Future

This year it launched Moocho, a next-generation plant-based cheese intended to satisfy dairy lovers, which Athos describes as “his baby.”

“We looked for a place where consumers trying our product would taste a revolutionary difference, not just an incremental difference. With all the attention on burgers, we thought plant-based cheese had been neglected,” he says. “Consumers have higher standards now, and these old technologies aren’t going to be enough to satisfy them anymore. We felt that it was time.”

Moocho cheddar and mozzarella shreds contain fermented ingredients to create the tangy flavor and texture of cheese. Unlike other cheese replacements, Moocho maintains the same chewy texture as milk cheese when cold as well as when melted. The product line also features cheesecake and cream cheese products that use the Moocho formula.

“There’s a lot of room for growth in the plant-based cheese industry, and I say that as a dairy lover,” says Sarah Masoni, director of the product and process development program at Oregon State University’s Food Innovation Center.

With so many different cheese varieties to re-create, products like Moocho have the potential to do for plant-based cheese what the Impossible Burger did for protein patties.

As the vegan-food market grows, Masoni cautions these companies could find themselves competing over resources. Many plant-based meats are made from the same base ingredients, like soy.

As more companies enter the space, they will compete over supply lines. Products like Moocho, which uses other ingredients to imitate different animal products, avoid this potential trap.

The plan was for Moocho cheese to follow in the footsteps of the Beyond and Impossible burgers. The shreds were set to debut in restaurants and pizzerias to generate buzz before an eventual release in stores. Then COVID-19 interrupted the company’s plans.

A shopping surge at the start of the pandemic meant the company had to move fast to keep up with demand. The Moocho launch was placed on hold as Turtle Island Foods went into heavy production. Once the initial push was over, now-struggling restaurants became less interested in adding new items to the menu.

With the restaurant-rollout strategy no longer an option, Moocho was put on a fast track for launch at regional natural-food chains.

Moocho’s stymied launch meant a missed opportunity for the company to break into the food-services sector. Getting Moocho onto restaurant menus is still a priority. But the pandemic has caused plant-based food consumption to increase yet again. Just like working from home and online shopping, COVID-19 has accelerated the growth of plant-based eating.

According to a report from Nielsen, a data analysis firm, sales of plant-based protein have increased 35% over the course of the pandemic, more than the 10% average increase among other grocery products. Turtle Island Foods was already expecting double-digit growth this year, but the onset of the pandemic caused sales to jump by 25%.

Even when adjusted for the initial surge in grocery buying, Masoni says the pandemic has quickened the adoption of plant-based food habits.

“People aren’t going out to eat as much, so they have become more intentional about what they buy and think more how it affects their health and the planet. I think these changes are going to last. They say it takes two weeks to change a behavior, and we’ve been going on like this for six months now.”

The pandemic has also exposed the vulnerability of the meat industry supply chain. Cold, damp meat-packing facilities make ideal breeding spots for infection. According to the Environmental Working Group, an activist group, COVID-19 infection rates in communities within 15 miles of meat plants are twice the national average.

A report by the Bureau of Labor Statistics found the price of animal products, particularly meat, increased during the pandemic due to shutdowns and bottlenecking. Consumers turned to plant-based protein as an alternative.

“When a rancher slaughters an animal and is then not able to sell it, it’s a huge wasted investment. Plant-based companies can just throw the peas they didn’t use into the freezer,” says Kyle Gaan, an analyst who studies plant-based food trends at the Good Food Institute. “The meat industry is extremely vertically integrated, and buyers are starting to take notice.”

Vegans and vegetarians are still a relatively small segment of the population. The explosion of plant-based foods has been driven by a rise in “flexitarians” who eat both animal and plant-based products. That means consumers are actively choosing between plant-based and animal products regularly.

Some meat lobbyists have appealed to state legislatures for help containing the spread of plant-based foods. In 2019 Tofurky entered a legal battle with the state of Arkansas where a law was passed fining any plant-based product which labeled itself as a “burger,” “sausage,” “roast” or any other word related to animal meat.

The law would have required new packaging, and dealt a harsh blow to plant-based protein in the state. Although a federal court blocked the law from being enforced, similar legislation has been put in place in Missouri, Mississippi and South Dakota.

In 2016 Athos became a founding member of the Plant Based Foods Association, an advocacy group created to ensure a fair and competitive marketplace for plant-based products. The association has 176 members, including Beyond Meat, Impossible Foods and Califia Farms. Athos serves as president and provides guidance to other plant-based startups, including Louisville Vegan Jerky Company.

Part of the company’s mission this year was to get more exposure on college campuses. That strategy was also slowed down by the pandemic. Tofurky’s senior vice president of strategic growth, Erin Ransom, says appealing to college-age consumers remains a core part of the company’s mission to grow the market.

Evidence suggests younger generations are more willing to adopt plant-based eating habits than older ones. Introducing students to affordable products in dining halls helps to ensure they will be acquainted with plant-based eating as they grow into consumers.

Erin Ransom, senior VP of strategic growth Photo by Jason E. Kaplan

Erin Ransom, senior VP of strategic growth Photo by Jason E. Kaplan

“Our most important branding opportunity is in our packaging,” says Ransom, as she showed me the happy hot dogs and timid tomatoes, which are meant to give the products a whimsical feel. By keeping the price low, the flavor high and the branding playful, Ransom’s goal is to dispel the persistent notion that plant-based foods are only meant for high-end shoppers.

“We want everyone to feel like they are welcome to our product. We want people to think of our product as something that’s going to be really delicious and also something they can toss on their canned chili and warm up in the microwave.”

One area the company is not focused on is making Tofurky products healthier. Despite Tofurky products containing high quantities of sodium, expanding into new markets means re-creating the experience of meat and cheese as much as possible. “For us, the focus right now is on the flavor and the eating experience,” says Athos.

Tofurky products continue to sell well in Australia and the United Kingdom, countries that have also seen a rise in plant-based eating. Athos now has his sights set on emerging markets in China and India. A burgeoning middle class, climate-change awareness and a cultural comfort with meatless protein could mean opportunities to create a new generation of plant-based consumers in Asia.

Founder Seth Tibbott was inspired by Asian cuisine when he created Turtle Island Foods. His company breaking into the Asian food market could be seen as coming full circle. Tibbott’s original dream of plant-based popularity in the U.S. may already be realized.

But for Athos, the work continues on a scale larger than ever before. “At first plant-based eating was ignored, then it was a pejorative, now it’s become a cool thing,” says Athos.

“Our goal is to continue making tasty products that lure people into eating plant-based rather than shaming them into it.”

To subscribe to Oregon Business, click here.