Improved data on wildfire risk provides opportunities for insurers.

Last year set new records in the history of wildfires, introducing a new era of climate-related risk. The Camp Fire in Butte County, California, which destroyed the town of Paradise, was the deadliest and most destructive fire on record in the state. At least 88 people died, 150,000 acres burned and 18,000 structures were destroyed, according to Cal Fire statistics.

In addition, two other California fires, the Hill and Woolsey fires, which broke out at the same time as the Camp Fire on Nov. 8, caused widespread destruction.

As of April 2019, insurance claims from the three fires exceeded $12 billion — making them likely the costliest fires in U.S. history when insured-loss data are compiled.

While California has the most households at risk of wildfires, Oregon is not far behind. Oregon ranks ninth of U.S. states for the highest percentage of households at high or extreme risk from wildfires, according to Verisk Wildfire Risk Analysis.

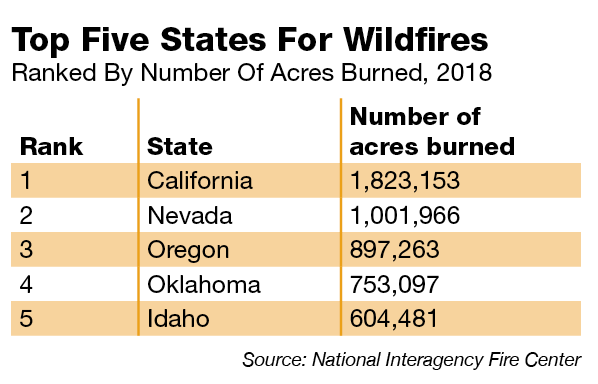

In 2018 Oregon ranked third in the country for the number of acres burned.

Insurance companies are on high alert, not only because they have a lot to lose from homeowner insurance claims; they also have a lot to gain from shoring up policies to cover increased wildfire exposure.

Improved availability of geospatial data makes the insurers’ job of analyzing wildfire risk much easier. The U.S. Forest Service’s Fire Modeling Institute has developed a map that insurers can use to predict wildfire likelihood and intensity.

Harris Clarke, wildfire expert at Washington-based PEMCO Insurance, says the company can rely on “more and more data to make good decisions.”

As a result of data analysis, the insurer found it was exposed to heightened property-damage risk in certain areas of Washington and Oregon. It has considered buying more reinsurance to cover the exposure.

Insurers will have to rethink their scope of coverage and modeling as wildfires become more common and severe because of the changing climate.

Earlier snowmelt due to warming in the spring and summer has led to hot, dry conditions that increase the risk of wildfires in much of the western U.S.

Large wildfires burn more than twice the area they did in 1970, and the average wildfire season is 78 days longer, according to the Center for Climate and Energy Solutions.

Yet the insurance sector only started to include catastrophic wildfire risk into modeling in 2018 after California’s devastating fire season.

“Insurance companies are looking at wildfire risk through a different lens,” says Clarke.

The Eagle Creek Fire in the Columbia River Gorge, which started in September 2017 and caused smoke to cover the Portland metro area for several days, did arguably more to raise public awareness of wildfire risk in Oregon than any other fire in recent memory.

Wildfires have been in the public eye for several years in Southern Oregon and have had serious impact on businesses. The most notable business affected is the Oregon Shakespeare Festival in Ashland, which last year lost millions of dollars after canceling several theater performances because of wildfire smoke.

Despite raised public awareness, homeowners who live in high-risk areas often neglect to make their homes fire-proof. Clarke says he recently visited a policyholder near Spokane, Washington, who had done nothing to protect his house because of a lack of understanding of wildfire-prevention measures.

Homeowners and businesses can take simple steps to protect their property, he says. Most houses that ignite because of wildfire do so because of flying embers. To prevent this, property owners should make sure nothing is combustible within 30 feet of the property. This includes removing overhanging trees and stores of bark mulch and firewood.

One sector that is set to benefit from increased wildfires is the risk-management industry. PEMCO contracted with Wildfire Defense Systems, a wildfire risk-management firm, to manage its exposure. The Montana company provides services such as property-claims forecasting, loss-prevention services and training.

As wildfires increase, the risk to public health and property is inevitable. But business solutions, such as risk and forestry management, will have the chance to flourish.

To subscribe to Oregon Business, click here.