The CBRE report suggests difficulty changing medical offices and inability to adapt to remote work are behind the lag.

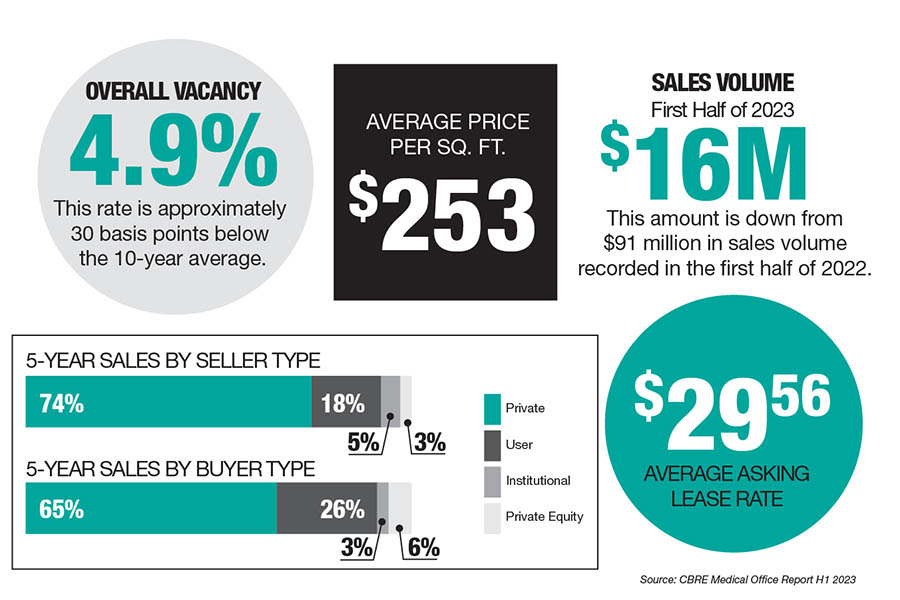

Sales momentum for medical offices slowed significantly in the first half of 2023, totaling $16 million in sales volume, down from the $91 million in sales volume recorded in the first half of 2022, according CBRE’s bi-yearly medical office trends report for the Portland area.

The report also found the Portland medical office market continues to experience strong demand, with health care tenants showing strong commitment to long-term leases.

The report found relocating medical practices posed significant challenges due to serval compounding factors – including disruptions in the global supply chain, increasing costs of construction and lengthy time frames to obtain permits.

The report, which includes data on all medical buildings 5,000 square feet or largerin the Multnomah, Clark, Washington and Clackamas Counties, found medical office tenants who were faced with the decision to either renew their current lease or relocate preferred to stay in their current setup.

“Medical practices tended to be closely tied to a specific location, and are hesitant to move more than two miles away due to the potential risk of losing their patient base,” the report reads.

The report also found medical office practices unable to adopt a hybrid work schedule, in contrast to the conventional office market in Portland, which has seen growth in companies adopting hybrid work models.

The Portland medical office market vacancy rate stands at 4.9%, still approximately 30 basis points (0.3%) below the 10-year average.

Available medical office space was most prevalent in Clark County, (24%) and Beaverton, (14%) with Lake Oswego (3%) having the lowest supply.

To subscribe to Oregon Business, click here.