State economist says the data is consistent with the city’s population slump, and might make the state’s most expensive city more affordable.

Vacancies are up in the Portland rental market — and rents are rising more slowly, according to a new report from Multifamily Northwest.

Last week the landlords’ group released its bi-annual apartment report, which showed that an average of 5.09% of rental units in the Portland/Vancouver metro area are vacant, higher than the 3.56% vacancy rate one year ago. Rent increases have also slowed significantly and some key submarkets have shown declining average rents, according to the report.

The cities of Milwaukie and the Troutdale had the lowest vacancy rates at 3.73% and 3.75% respectively, followed by Aloha at 3.82%.

The study also found the new construction pipeline is limited. As of early 2023, there are around 10,000 apartment units under construction across the Portland-metro area, a decline from early 2020, when there were 12,500 units under construction.

The data mirror larger national trends. According to January data released by Apartments.com, the national vacancy rate was 6.2% on the last day of December 2022, up from 5.7% at the end of the third quarter. Similarly, an imbalance between supply and demand pushed the national year-over-year rent increases down to 3.7%, and the study predicted slower rent growth during 2023.

According to U.S. Census data compiled by HelpAdvisor.com, in 2022 several major metro areas — including Sacramento, Calif., Richmond, Va. and Bridgeport, Conn. — had residential vacancy rates of less than 2%. Fort Myers, Fla., had the largest vacancy rate in the country, with 21.2% of its rental units available.

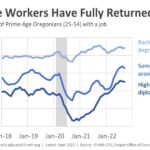

Part of the downturn could be related to the trend of people fleeing large urban metros — both in Portland and nationwide — in favor of smaller cities. Remote work has been a significant driver of this trend. COVID-19 caused many people to leave expensive cities for more suburban cities or small towns. According to a Gallup research study released in August 2022, the number of remote workers in the United States tripled, from 10% or less of the U.S. labor force to more than 30% currently.

“This new report clearly shows we’ve taken a step back where housing demand and household formation was negative. I think it’s a clear indication of a decline in rental demand in the Portland region,” state economist Josh Lehner tells Oregon Business. He says that in the short term, the slower price increases are likely to encourage the formation of new households.

Tactics: Looking Forward With Josh Lehner

“The economy is still growing; we’re not in a recession yet. And so household incomes are going up, and we have rents that are relatively unchanged. Affordability is still terrible, but on the margin, we’re seeing improvements because of this dynamic which should encourage household formation,” Lehner says. (According to rent.com, the average rent for a one-bedroom apartment in Portland was $1,537. While that figure is down 2% from 2022, it’s still out of reach for a person earning less than $74,500, the median income for the metro area in 2022.)

He says from a rental perspective, further declines are likely, but that the slowdown in rental prices is probably temporary.

Lehner says he expects the return of migration to Portland and rebound in population growth to create more rental demand in the years ahead, but that the key area of interest to watch in Oregon is in its population, which has seen a decline over the last three years.

If migration to Portland does not rebound to pre-pandemic levels and out-migration continues across urban cores throughout the country, it could represent a fundamental shift in demand for urban rental units.

“The question is, is that process just getting started? We saw the working from home and outward migration during the pandemic. Is this what we’re going to be seeing over the next five years? Are we just talking about the city versus the suburbs, or are we talking about Portland competing with Boise, Spokane and Tucson and Salt Lake City, which are more affordable,” says Lehner.

“I think the city versus suburbs is going to be with us for a while from an economic and demographic perspective, but the longer distance migration? That’s what I don’t know,” Lehner adds. “I have no idea.”

To subscribe to Oregon Business, click here.