Businesses innovate to survive the biggest challenge of a lifetime.

It is hard to fathom the impact of the coronavirus pandemic on the state’s economy. The forced closure of many businesses and the accompanying layoffs are a stark reminder of the unprecedented damage of the health crisis.

Economic data lay bare the extent of the fallout: At the end of March, the Oregon Employment Department reported a record 97,200 claims for unemployment in the prior week, surpassing the previous record of 76,500 set the week before. That was triple the previous record set during the Great Recession, according to the Oregon Office of Economic Analysis.

The jobless claims are spread across most sectors, with the biggest increases in leisure and hospitality. Retail businesses, including gyms and salons, are the next worse affected. Health care is also heavily impacted with reductions in elective surgeries and procedures, and the closure of dentists.

The pandemic is hitting small businesses especially hard. It has caused shifts in the economy that favor large companies, such as large e-commerce and tech firms, where demand for services, such as data streaming, is surging as social distancing measures require people to work and shop at home.

Oregon is a state built on small business. More than 50% of jobs are created by the sector. The state has fewer of the large public and private companies than other states have, making the fallout of the pandemic particularly painful.

But amid the gloom are shafts of light. Businesses are adapting and innovating to keep afloat. Restaurants have turned to home delivery; arts organizations are live-streaming performances; manufacturers are converting their production lines to make products to fight the pandemic. This effort at adaption is allowing companies to avoid layoffs and keep revenues flowing. And banks and credit unions are working long hours to lend to businesses facing an unprecedented cash crunch.

This innovation and resiliency engender hope and optimism, which will be essential to get through the economic crisis. The following stories illustrate how businesses across a variety of sectors are adapting to the new reality

Product makers find new purpose making equipment to combat the pandemic.

Alan Dietrich could talk all day about the ins and outs of making and selling liquor. It is his job, after all, as CEO of Crater Lake Spirits, a distillery in Tumalo.

But it was quite the learning curve for him when his company entered a new market in March, making a product he previously knew little about: hand sanitizer.

The manufacturing switch is the result of a shortage of the hygiene product. Other products in short supply include protective gear for health care workers, such as rubber gloves and face masks.

The World Health Organization estimates 89 million medical masks are required for the COVID-19 response globally each month. Supplies can take months to be delivered and market manipulation is widespread, with stock frequently sold to the highest bidder, according to the organization.

Distilleries are uniquely placed to make hand sanitizer because they are used to making alcohol-based products. But despite the relative ease of making hand sanitizer, the switch was not something Dietrich says he even remotely imagined his company would do. “This pandemic is forcing real changes,” he says.

Most distilleries in Oregon are making hand sanitizer to meet the increased demand. Rogue Ales & Spirits in Newport has produced 260 gallons so far.

Distilleries are not making a profit from hand sanitizer. The product is shipped to the Oregon Health Authority, which covers the hard costs of production and distributes the product to hospitals and health centers.

But production of hand sanitizer has allowed Crater Lake Spirits to retain some staff. The distillery let go about a dozen employees. The company lost business from the closure of bars and restaurants, where it used to sell liquor.

It is not just distilleries that are heeding the call to help fight the pandemic. Other manufacturers have converted their production lines to make personal protective equipment for health care workers.

Sailworks, a Hood River manufacturer of windsurfing equipment, is one such company. Production of the business’s core product ground to a halt after its supplier in China had to shut down as a result of the coronavirus outbreak. Windsurfing has also stopped in Oregon because of the closure of parks that provide access to the Columbia River, where people go surfing.

Bruce Peterson, owner of Sailworks, is kept busy, however, making another type of product: face shields for health care workers. Demand has soared for protective gear, but China, which traditionally makes these products, has not been able to keep up with demand because of disruption to its own manufacturing.

In March local health care facilities put out a plea for thousands of face masks and face shields. Peterson got a hold of a specification for a face shield and found that it uses the same plastic material Sailworks includes in windsurfing sails.

The company got to work making samples and prototypes that it sent to local hospitals. Peterson says he wanted to make sure the face shield was a product that health workers could use. The response was overwhelmingly positive.

Sailworks is on track to make 6,000 face shields, which are distributed to local hospitals. It is making no profit on the product. A nonprofit, Handmade Brigade, is raising funds to cover the costs that manufacturers such as Sailworks incur from making personal protective gear.

Peterson has no plans to add face shields to Sailworks’ product line. Larger companies can do a better job of manufacturing long term, he says. But he hopes the shortage of medical protective gear is a wake-up call to businesses of the vulnerability of the global supply chain. The U.S.’s reliance on cheap medical products from overseas has put it in a precarious position when it comes to efforts to deal with its own public-health crisis, he says.

Anxiety and being stuck at home drive marijuana sales.

From restaurants to movie theaters to hotels, the outbreak of coronavirus has ground many businesses to a halt.

Yet for Aviv Hadar, co-founder and CEO of cannabis-dispensary chain Oregrown, business is booming. Sales more than doubled between February and March.

“Our sales have soared on the retail side,” says Hadar. “For the first time, we’re seeing what the medi-curious customers look like: people who come in for anxiety issues and PTSD. We get a lot of veterans in here.”

Cannabis is one of a handful of sectors that is doing well from the pandemic. Supermarkets, home-improvement stores, e-commerce and data centers are areas of the economy that have seen surging demand.

Hadar says the outbreak might have led to more anxiety among consumers, who are curious about using marijuana and CBD products for stress relief.

Market research company Brightfield Group found in a survey that 31% of cannabis consumers plan to use the product more frequently as a result of the COVID-19 crisis. Few planned on changing their preferred way of consuming cannabis. The report also found an increase in users who plan to consume CBD products.

According to marijuana-delivery platform Eaze in California, first-time deliveries increased 51% since March 13.

Navigating the outbreak has not been smooth sailing, however. Hadar had to put new guidelines in place to keep staff and customers at a safe distance. “COVID has impacted the business in every possible way,” he says, from creating social distancing at the counter to changing the way products are handled to making products available for delivery.

The biggest change — and potential challenge — will be how the virus affects seasonal revenue. Cannabis consumption usually increases during spring and summer. Hadar is unsure those trends will apply this year.

It is also possible the spike in cannabis consumption simply represents a change in consumer behavior due to quarantine.

As bars, theaters and restaurants shut down, people are spending money on things that can be consumed from the comfort of their own home.

Hotels innovate as bookings plummet.

Francesca Amery could finally take a breath. Her six-bedroom Ashland inn was booked through the summer. It was the beginning of March and the busy season was about to start.

Soon tourists would come from all over the world to get a taste of Ashland’s culture, cuisine and outdoors.

She had already filled her fridge and pantry with $800 worth of food when the cancellations began. “I heard people’s hearts breaking on the phone,” says Amery. “They said they wished they didn’t have to cancel, but they were afraid.”

One cancellation came from a couple who had been quarantined in Spain and had planned on making Ashland their wedding destination.

“She’d just had to cancel her wedding and her honeymoon, but she told me she understood it was hard for me, too, and offered to pay half of the booking anyway,” says Amery, recalling the emotional conversation with the bride. “I was in tears, I felt so grateful.”

Domestic travel decreased 14% in the first week of March, according to travel booking company Hopper. The company’s report shows an even steeper slowdown for tourist destinations, with travel declining closer to 30%.

According to the American Hotel and Lodging Association, 44% of hotel employees are projected to lose their jobs in April.

Neuman Hotel Group, which owns four Oregon hotels, had 350 active employees before the virus hit. After a rash of cancellations, the group furloughed nearly two-thirds of its staff. The company has been able to retain the rest of its employees by coming up with new ways to make money, including having its restaurants offer curbside delivery as well as preparing family-style casserole dinners to go.

“Our employees who were furloughed are able to use their paid-vacation and sick-leave balances,” says chief operating officer Don Anway. “Our plan is to send out communication a couple times each month while our employees are furloughed.”

Some local governments shut down the hospitality sector completely, such as Seaside and Clatsop counties, which suspended all hotel operations.

But in times of hardship, there are those who rise to the occasion. The Washington County Visitors Association issued a sustainability grant to assist hotels. The association will commit $560,000 to be dispersed to the 56 hotels in the Tualatin Valley.

Lenders grapple with mounting loan requests.

Staff at Rogue Credit Union, a lender in Medford, have worked around the clock to process applications for the federal government’s $349 billion in loans to help small businesses pay staff for eight weeks.

The credit union typically would process between half a dozen and a dozen applications for business loans a month. It received more than 100 loan requests in the four days following the program’s launch on April 3.

It is a tall order to implement a financial aid program, known as the Paycheck Protection Program, in a matter of days that would typically take months to stand up, says Gene Pelham, CEO of Rogue Credit Union.

“Our biggest challenge was that there wasn’t good guidance on the program” in the beginning, says Pelham. “Businesses felt they needed to apply now before the money goes away. Our team has been working 24/7 over the past several days to work out how we can help our members.”

Banks and credit unions have become pivotal in helping to support companies financially through the downturn, while dealing with their own challenges of operating through a lockdown.

The Paycheck Protection Program, which is funded under the Small Business Administration’s Business Loans Program Account, provides small businesses with fewer than 500 employees up to $10 million to pay staff for two months.

The loans are forgivable as long as organizations keep all employees on payroll – or rehire them by June 30, 2020. Most of the loan amount must be used to cover payroll costs.

Umpqua Bank received around 6,500 applications for Paycheck Protection Program loans in the first 24 hours of launch, says Tory Nixon, chief banking officer at Umpqua.

The $349 billion program ran out of money in mid-April. The federal government replenished it with $310 billion last week.

The main difference characterizing the economic impact of today’s crisis compared with past ones is that it happened abruptly, with businesses open one day and then forced to shut the next.

“The pandemic has left no industry untouched, and small businesses of all types are in need of emergency relief capital,” says Nixon.

Umpqua Bank invested $750,000 in the Small Business Relief Fund set up by the City of Portland, Prosper Portland and a group of businesses represented by the Portland Business Alliance. The fund provides grants and zero-interest loans of up to $50,000 to businesses with less than $5 million in revenue.

One important difference with this crisis compared to the financial fallout of the housing crisis in 2008 is that banks are less leveraged than they used to be. Higher capital standards introduced since 2008 means financial institutions are in a better position to lend this time.

How long the pandemic and the resulting shutdown will last is the million-dollar question everyone is grappling with. And that is what makes for a truly unprecedented lending environment. “There are no past models to rely on and there’s no guarantee,” says Nixon.

Foundations strive to keep nonprofits providing essential services running.

In march and April, George Devendorf, executive director of Transition Projects, had to self-isolate from his family. His organization supports more than 10,000 homeless people in Oregon. The work is essential. It is also high risk. People who are homeless are considered at higher risk of contracting COVID-19 because of problems they face self-isolating, among other reasons. Individuals who work closely with them must take extra precautions around their own families.

Many nonprofits have continued their work during the COVID-19 outbreak, with some adjustments. Self Enhancement, a mentorship nonprofit for children of color, and SMART Reading, an early-childhood development nonprofit, moved courses online. Meals on Wheels reduced weekly visits but began a “Friendly Chat” program to have wellness calls with seniors.

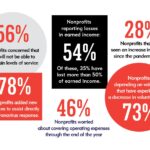

Above all, funding remains the most pressing issue to keep staff and operations going. Jim White, executive director of the Nonprofit Association of Oregon, says many nonprofits are facing sharp declines in revenue. And a clunky rollout of government assistance at the federal level has caused anxiety over whether the funds would be readily available.

“By and large, earned revenues are the largest source of funding nonprofits get, and you can imagine how social distancing is having an impact on that,” says White. “The second largest source of funds are government grants, and they are having difficulty getting money out the door.”

The federal government made money available to nonprofits through the Small Business Association’s Paycheck Protection Program (PPP) on April 3.

“Some lenders weren’t accepting applications until they got instructions to do so. Others were accepting applications, but they were using outdated instructions,” he says. “Over here we called it ‘PPP pandemonium.’”

Another issue when applying for funds, says White, is that the uncertainty felt by nonprofits causes them to apply for as many grants as they can, leaving grantmaking administrators flooded with requests.

Mercy Corps initiated the COVID-19 Resilience Fund, which the organization spends on global efforts to combat coronavirus. It established peer-to-peer fundraising networks online, and while giving might decrease as donors reduce spending, the nonprofit created other ways for corporations and individuals to get involved.

“We are shifting focus to the large influx of business-support inquiries we are receiving,” says Lynn Hector, media and communications manager at the Mercy Corps Portland office. “We are using our expertise in business services to provide education for local businesses on pivoting operations and where to find funding.”

Foundations have also lent support. In the first month of the crisis, the Oregon Community Foundation mobilized $6 million through its network of more than 2,000 individual donors to develop the Oregon Community Recovery Grant program. The foundation has disbursed more than $4 million to Oregon nonprofits so far, giving preference to organizations serving underprivileged communities.

One of the organizations it helped fund was Transition Projects. “We just heard back from the Oregon Community Foundation, and they responded positively to our request,” says Devendorf. “The challenge for us now is not getting bogged down in the details and looking just around the corner instead of way off into the future.”

Devendorf says that while there is not much of a bright side to the pandemic, it has helped keep the lines of communication open between nonprofits and grant-making organizations, as well as between organizations that serve similar populations.

“I’ve gotten very close to my peers, my fellow executive directors,” says Devendorf. “It’s important because many of the people we serve are served by multiple agencies. One day they might be coming through your door, and the next day they could be coming through mine.”

Health clinics rally together to lobby for financial relief.

Telemedicine visits have surged since the COVID-19 oubreak, but health clinics and hospitals are hurting from the cancellation of in-person procedures that bring in most revenue.

Dick Clark, CEO of The Portland Clinic, says his clinic’s inability to perform as many surgeries has had a “devastating” impact on revenue.

“In-person visits have gone down 90% since the coronavirus outbreak,” says Clark. “We are projecting our revenue to be off 60% in April.”

The clinic, which employs 575 people, will furlough 180 employees in April and May, and has had to reduce staff hours to help with cash flow. The clinic has also closed two of its five locations. The Oregon Clinic, meanwhile, furloughed about 820 employees.

While hospitals nationwide will be eligible to receive at least $100 billion in financial aid as part of the federal government’s COVID-19 relief package, many midsize clinics with more than 500 employees, such as The Portland Clinic, are not eligible for the Small Business Association’s Payroll Protection Program.

“The good news is, we are expecting a surge of demand for health care beyond the COVID crisis,” says Clark, “but our clinics right now are on the brink of not being able to make it. There’s a gap in funding, and we are very fearful of that gap. We are unlike hospitals who are benefiting from federal support.”

Clark came together with CEOs from the Oregon Medical Group in Eugene, The Corvallis Clinic, The Oregon Clinic and other medium-size providers to hire a lobbyist to advocate for the work provided by clinics.

Hospitals have also had to scale back. “About half of the procedures we’ve had to cancel or postpone have been elective procedures,” says Brian Terrett, director of public relations and communications for Legacy Health. “But the other half were procedures to help people with chronic conditions.”

Legacy Health has benefited from sharing information with hospitals in Washington, says Terrett. “We heard from places in Seattle that they wished they would have started saving personal protective equipment before the virus hit, so we made sure to do that.”

Legacy Health partnered with dental equipment manufacturer A-dec to provide protective masks to health care employees.

Rural hospitals and clinics also face a large burden from COVID-19. Oregon Sen. Jeff Merkley, along with a bipartisan coalition of 18 of his Senate colleagues, asked the U.S. Department of Health and Human Services to consider the special needs of rural hospitals when the department distributes federal funds. He argued that rural clinics are often the only choice for locals.

“Prior to the COVID-19 pandemic, rural hospitals were already operating on shoestring budgets and, with the cancellation of elective procedures, have a desperate and immediate need for more funding,” wrote Merkley.

Arts organizations go digital to protect fragile institutions.

Portland Center Stage had just opened the Broadway smash hit “The Curious Incident of the Dog in the Night-Time.” Managing director Cynthia Fuhrman was confident from the positive audience response that the show would make enough in ticket sales to offset the hefty production costs, large cast and royalties associated with the production.

Then the theater went dark.

After Gov. Kate Brown’s statewide ban on gatherings of 25 people or more, performing arts organizations across the state were forced to shut their doors.

Arts professionals sprang into action, contacting state and federal legislators, as well as organizations such as the Oregon Arts Commission and the National Endowment for the Arts, to protect the state’s cultural institutions.

“Most arts nonprofits only make it month to month as it is, especially smaller ones,” says Fuhrman. “This is why we are pushing legislators for more grants and paid leave. We are going to do everything we can to make sure these organizations survive.”

In Ashland the Oregon Shakespeare Festival is not only a large source of revenue but also a supplier of housing for 120 visiting artists. After struggling against forest fires the past three years, coronavirus means the institution once again faces a season beset by financial difficulty.

Organizations have turned to digital performances to get around the restrictions.

Portland Baroque Orchestra helped to live-stream a concert by professional vocal group Cappella Romana, and has now revised its mission statement to include supporting other arts organizations and artists live-streaming their work.

The Oregon Cultural Trust released a list of arts organizations that are taking their craft online by streaming performances, readings and recordings of their work. While it may not be possible to see the art live, creators are doing their part to ensure the arts do not fade from memory during the difficult days ahead.

To subscribe to Oregon Business, click here.