BY JASON NORRIS, CFA | OB GUEST BLOGGER

BY JASON NORRIS, CFA | OB GUEST BLOGGER

Pets.com, GeoCities, eToys, and WorldCom … blasts-from-the-past that all signify the late 1990s Internet bubble. Yet we believe the dynamics of the market, specifically in technology stocks, are much different today than it was during the late 1990s.

BY JASON NORRIS, CFA | OB GUEST BLOGGER

Pets.com, GeoCities, eToys, and WorldCom … blasts-from-the-past that all signify the late 1990s Internet bubble.

In 1998, a company could get a higher valuation by simply adding a “.com” to its name and overnight it transitioned to an Internet stock. Remember K-tel, one of the original “as-seen-on-TV” companies whose self-inflicted .com bubble blew up in 1998 and then burst shortly thereafter? This 20th century “tulip mania” drove technology-focused indices to sky-high prices that the underlying businesses could not support.

In 1998, a company could get a higher valuation by simply adding a “.com” to its name and overnight it transitioned to an Internet stock. Remember K-tel, one of the original “as-seen-on-TV” companies whose self-inflicted .com bubble blew up in 1998 and then burst shortly thereafter? This 20th century “tulip mania” drove technology-focused indices to sky-high prices that the underlying businesses could not support.

But it didn’t matter. It was similar to the Dutch fostering a tulip bulb craze in the 1600s. As long as “investors” believed that the “asset” could be sold at higher prices, there would be very active buyers. However, when the market price of an asset greatly overstates the underlying asset value … eventually the price has to fall. And it can be ugly, as we all saw in 2000.

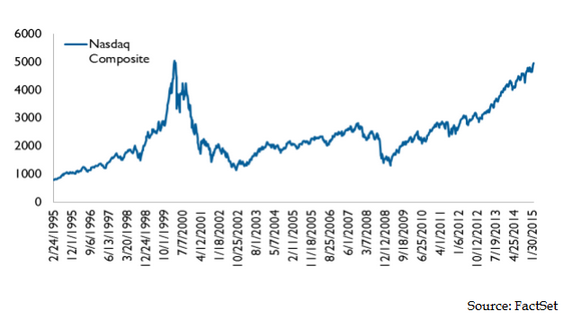

Fast-forward to 2015. Earlier this month, most major equity indices in the U.S. reached all-time highs. The S&P 500 and Russell 2000, for example, have been tacking on gains regularly over the last several years and it appears that the “bubble” peak of 2000 is now a distant memory.

This is the case for most global benchmarks, excluding the tech-heavy NASDAQ Composite. The NASDAQ has not seen the 5,000 level, which it is flirting with now, since March of 2000. As the chart indicates below, it has been a long, tough grind to reclaim these levels, which could not have occurred without the iPhone.

iPhone maker Apple is now the largest company in the world, with a market value of over $725 billion. When the NASDAQ peaked in 2000, Apple had a value of just over $22 billion. There were very few technology stocks that would have made sense to buy in March 2000, but Apple would have been one of them. The largest company at that time was Cisco Systems, fetching a market value of over $500 billion. Today the company is two-thirds smaller at $150 billion.

We believe the dynamics of the market, specifically in technology stocks, is much different today than it was during the late 1990s.

The largest holdings at that time were trading at P/E ratios between 40-120x earnings. Today, Apple is trading at 15x earnings. Even Microsoft and Intel, which were large positions and continue to be in the index, have seen their P/Es fall by over 70 percent. Therefore, as the press focuses on the NASDAQ getting close to record highs, it is not quite as lofty as it was previously and investors should not run to the exits.

Don’t You Want to Go … 1999

While the public markets seem to be a bit more rational regarding valuations, the private markets may be another story. Social media app Snapchat is looking to raise funds that would value the company at $19 billion, almost double from what it was six months ago. Uber’s most recent capital raise valued the company at $40 billion. One factor that is “driving” these values is basic supply and demand.

Most large investment institutions (foundations, endowments, etc.) have a meaningful allocation to private equity. These institutions typically have over 50 percent of their assets in alternative investments, which is more-than-double the allocation to U.S. public equities. A greater supply of dollars has to find a home, which in turn is pushing values up. Only time will tell if it is warranted. Hindsight shows that Google’s $1.7 billion purchase of YouTube is paying off and it’s still early regarding Facebook’s $1 billion purchase of Instagram.

Alternative investments have positives and negatives. Depending on the investment, they can provide increased diversification with the opportunity for enhanced return. However, these investments usually have very little liquidity. Consequently if an investor needs to sell, it does not happen instantaneously, like a public security, and may take up to a year to get funds.

The Coin Flip

From the global economy to what’s happening here in Oregon

Major Oregon investment institutions are participating in the trend of increased alternative investments. The Oregon PERS plan has 20 percent of assets in private equity. The foundations that support University of Oregon and Oregon State University have their share of alternatives at 63 percent and 46 percent, respectively. These investments can be appropriate to institutions that have a very long term-time horizon.

Jason Norris, CFA, is executive vice president of research at Ferguson Wellman Capital Management. Ferguson Wellman is a guest blogger on the financial markets for Oregon Business.