What is it with Oregon and its beer? Is it the climate? The water? The hops? A parochial form of beer-based patriotism?

DRINKING AGE

DRINKING AGE

OREGON’S CRAFT BEER INDUSTRY GROWS UP.

BY BEN JACKLET

What is it with Oregon and its beer?

Is it the climate? The water? The hops? A parochial form of beer-based patriotism? A statewide predilection for the niche market with a dreamy upside, be it solar power, organic produce or India Pale Ale?

Whatever it is, it’s working.

285 million bottles of beer on the wallOregon’s brewing industry by the numbers | |

| 63: | Number of brewing companies in Oregon |

| 88: | Number of brewing facilities in Oregon |

| 1: | Portland’s rank among U.S. metro areas for craft brewing markets |

| 1: | Oregon’s rank among states, craft beer consumption per capita |

| 2: | Oregon’s rank, hop production |

| 4: | Oregon’s rank, breweries per capita (behind Vermont, Montana and Maine) |

| 860,000: | Barrels of beer brewed in Oregon in 2007 |

| 5,000: | Brewery jobs in Oregon |

| $2.25 billion: | Annual impact of Oregon’s beer industry |

| 5.9%: | U.S. market share of craft beers by dollars |

| 3.8%: | U.S market share of craft beer by volume |

| 11.4%: | Oregon market share of local craft beer by volume |

| Sources: Oregon Brewers Guild, Brewers Association, John Dunham and Associates | |

Metro Portland has 38 breweries, more than any other city in the world. Statewide there are 80. In other states craft brewers dream of a future where 10% of the draft beer poured in pubs and taverns will be independently brewed by local artisans. Here that figure is nearing 40% and it won’t remain a minority share much longer. New brewpubs are bubbling with customers in small towns and cities all over the state, and the beer pioneers who launched the industry continue to grow, evolve and spawn creative start-ups. Two notable recent additions to Oregon’s brewpub population, Three Creeks Brewery Co. in Sisters, and Double Mountain in Hood River, were entrepreneurial efforts by former employees of the Lucky Labrador Brewing Company in Portland and Full Sail Brewing in Hood River.

No other state can match Oregon’s thirst for and fascination with craft beer or the robust diversity of its brewing industry, from the plucky Roots Organic Brewing Company of North Portland to the sprawling 2,000-job empire of the McMenamin brothers. Gov. Ted Kulongoski’s “Economic Vision for Oregon,” written in October 2006 to chart a strategy for the “innovation state,” singles out the “distinctive taste of an Oregon micro-brew” as a home-brewed innovation propelling the economy forward. Portland writer Jeff Alworth, author of the blog Beervana, compares Oregon’s beer culture to the Italian Renaissance.

Whether you think of it as an industry cluster or a cultural flowering, beer is serious business in Oregon. The industry celebrated its unofficial coming of age this summer with the 21st annual Oregon Brewers Festival, and the beer pioneers who started it all are still on the leading edge. A look at five of Oregon’s most distinctive beer barons — Jack Joyce of Rogue Ales, Irene Firmat of Full Sail Brewing, Kurt and Rob Widmer of the newly formed Craft Brewers Alliance, and Gary Fish of Deschutes Brewing — reveals plenty about how they helped build this quirky empire, and where they might lead it from here.

These five leaders and their strategies are as distinct from one another as are the beers they brew. The goal they share is to build on 20 years of evolution and growth without losing the commitment to creativity and fun that made them such a hit in the first place. As Gary Fish, founder and CEO of Deschutes Brewing, points out, “We haven’t even scratched the surface.”

PHOTOS BY DENISE FARWELL

ROGUE ALES

|

ROGUE BOSS OF A ROGUE NATION

Jack Joyce is the first to admit, make that announce with pride, that Rogue Nation has no use for HR departments, planning or discipline.

“We also have a saying around here that anything worth doing is worth doing half-assed,” Joyce adds.

How exactly has this business grown by more than 30% for each of the past three years?

HEADQUARTERS: Newport FOUNDED: 1988 OWNERSHIP: Jack Joyce, Bob Woodell and Rob Strasser (all formerly of Nike) FOUNDER: Jack Joyce PRESIDENT: Brett Joyce EMPLOYEES: 250 PRODUCTION: 60,000 barrels GROWTH: more than 30% each of the past three years BRANDS: Dead Guy Ale, Shakespeare Stout, Hazelnut Spiced Rum NEW DEVELOPMENTS: Leasing farmland and partnering with hop and barley growers; plans for using hop fiber as fabric for apparel WEB EXCLUSIVE: READ FULL Q&A WITH JACK JOYCE |

The 65-year-old Rogue founder is quick to reject or contradict the typical answer to that question, or any question for that matter. But get him talking, and powerful themes emerge: the interrelated powers of instinct, creative freedom, irreverence and good ideas. Oh yeah, and then there is the fact that Joyce was deeply involved from Day One with Nike’s launch and development of the Air Jordan brand. He knows a thing or two about pricing, marketing and brand loyalty. He understands the importance of developing world-class products that are worth a premium to consumers. He respects the power of “unique thunder,” his term for the creative interplay between consumer and business at the point of sale.

“The other thing we got out of Nike was a board,” he says. “We started at zero and we couldn’t afford the talent, but we had beer. So we got a nonshareholder board that’s been with us for years, which includes the former president of Nike, the former president of Adidas USA and the guy who ran production at Nike.”

Not bad. But the path to Rogue nationhood has been far from corporate. Rather than pursuing efficiencies, Joyce has built his 250-employee fiefdom through creativity and whim. He got into distilling after hiring a merchant marine who used to make hooch in the engine room. He got into farming for the fun of it, he says; it just so happened that the price for hops was in the process of quadrupling. He’s led Rogue into McMenamins-style beer lodging in Astoria and restaurants in the Portland International Airport, the Oregon Aquarium and the North Beach neighborhood of San Francisco. Rather than pawning the usual mugs and coasters through his website, he sells Rogue Nation yo-yos, tattoos and condoms.

Plan or no plan, it appears to be penciling out. Rogue ales have been selling in all 50 states for over five years, and Joyce says: “We aren’t just in these states. We sell through them.”

The latest adventure for Rogue involves leasing farmland for hops in the Willamette Valley and barley in Central Oregon. Joyce insists the analysis for Rogue’s foray into farming “does not exist to this day,” but it certainly was good timing, given the insane recent price bumps for beer ingredients, especially for hops.

Joyce and his partners are also exploring secondary uses of the hop plant for making fabric. If all goes according to non-plan, Rogue may one day release all-Oregon-ingredient Rogue Nation apparel to accompany its new all-Oregon-ingredient Independence Ale. Or it may not. It depends.

“We don’t do anything for money,” Joyce says of the farming venture, with a characteristic flair for contradiction. “But once we do something, then it’s a matter of pride. We’re going to make money at it.”

Joyce doesn’t claim to understand how Rogue Nation, a land of $5 beers, keeps booming even as the larger nation it operates inside faces hard economic times, with home values plunging and prices soaring. “I don’t know the answer to that question,” he says. “Especially in economic times like these. Unless there’s a list of things you won’t take off your shopping list no matter how bad things get. For our customers, Rogue is pretty high up on the list.”

Given that continued growth, any interest in taking Rogue public?

“God, no,” he laughs. “We wouldn’t pass the drug test.”

DESCHUTES BREWERY

|

DESCHUTES RIDES A SWIFT CURRENT

It will come as little surprise to those familiar with the rise of Bend’s Deschutes Brewery that founder and CEO Gary Fish is an intense skier. He has approached the business of beer with the gusto of a skier launching off a cornice into a field of powder. He has had to improvise and learn from his mistakes at full speed, because few would have predicted 20 years ago that the City of Bend or the business of craft brewing would become what they are today.

Deschutes is not distributed as widely as Full Sail, Rogue, or the brands of the Craft Brewers Alliance, but it is No. 1 within Oregon. Two decades of steady growth have enabled Fish to ramp up production in Bend and bring brewing back to Portland’s Brewery Blocks, with a 10,000-square-foot brewpub that opened in May. And while he is not offering specifics yet, he is entertaining options to take Deschutes national.

Fish, 51, grew up in a family that was deeply involved in the California wine renaissance of the 1960s and ’70s. Instead of following his parents into wine, he moved from California to Utah for the skiing. Then, after consulting with his father and helping a friend launch a brewpub in California, he decided to plunge in waist-deep with a brewpub in Bend in 1988. At first Deschutes struggled in Bend, but its reputation for quality spread, thanks to the artistry of brewmaster John Harris (now with Full Sail), who created recipes for Black Butte Porter, Mirror Pond Pale Ale and other distinctive Deschutes brews.

“For the first six or eight years we never had to sell any beer,” says Fish. “People just came and bought it. We had the brewing operation at the pub and we got a little building that we used as a warehouse. You haven’t lived until you’ve driven a forklift down a sloped parking lot with a full load of kegs in the middle of winter, with chains on.”

Next came the letters from the City of Bend concerning the problems with operating an industrial process in a downtown commercial business district. Fish bought property on the other side of the river and launched into bottling to boost volume and pay off debt. “We learned as we went and we made more than our share of mistakes,” he says. “But we were always making good beer, and the industry was growing rapidly.”

HEADQUARTERS: Bend FOUNDED: 1988 FOUNDER AND CEO: Gary Fish EMPLOYEES: 290 PRODUCTION: 163,000 barrels in 2007 (No. 1 in Oregon sales, second in total sales) BRANDS: Black Butte Porter, Mirror Pond Ale, Obsidian Stout, Jubelale GROWTH: on par with craft industry average (6%-8%) in the past few years NEW DEVELOPMENTS: 10,000-square-foot brewpub opened in Portland’s Pearl District in April; potential collaborations with large and/or small brewers to expand nationally WEB EXCLUSIVE: READ FULL Q&A WITH GARY FISH |

So was Central Oregon. Evoking the beauty of the high desert with brews like Bachelor Bitter and Obsidian Stout was a great strategy in Oregon. Winning market share outside of the Northwest, where people don’t think of Bachelor as a mountain, has proved more difficult.

“We have a lot of people on the East Coast who love our beer,” he says. “We would like to get it to them. We think that we will, but we don’t know how. Does it make sense in this era of $4 a gallon gasoline to make beer in Bend and ship it to New York? Probably not. Does it make more sense to make it on the East Coast? Yeah. If we can make it the Deschutes way. If we can make it to our standards. That kind of an alliance could be with a big brewery, it could be with a small brewery. Who knows?”

One thing Fish is certain about: the consumer’s appetite for more craft beer will only grow. Mention market saturation to him and you’d better be ready for powerful rebuttal. “People ask me: ‘There are 90 breweries in Oregon. How many breweries can Oregon handle?’ I turn it around. There are 350 wineries in Oregon. How many wineries can Oregon handle? There are 2,000 wineries in California. Have you ever heard anybody talk about saturation in the California wine industry?

“Saturation? Are you kidding me? [Craft brewing is] 4% of the market; 1,400 companies nationally share 4% of the market. And it’s growing, and it will continue to grow. Saturation? We haven’t even scratched the surface.”

CRAFT BREWERS ALLIANCE (FORMERLY WIDMER BROTHERS BREWERY)

|

GOING PUBLIC, GOING NATIONAL

The Widmer brothers weren’t the first Oregon craft brewers to serve up great beer, but they were the first to take craft brewing to new levels. In the 1990s they were first to gain access to Anheuser Busch’s legendary distribution system, and now they are first to go public, as part of a complex alliance with a 36% share soon to be held by InBev, the Brazilian/Belgian giant that is swallowing Anheuser Busch to become the largest brewer in the world.

So it’s a little surprising to hear Kurt Widmer, co-founder of Widmer Brothers Brewing and now chairman of the Craft Brewers Alliance, understate with a convincing poker face that “Nothing’s really changed around here.”

His brother and co-founder, Rob Widmer, now vice president of corporate quality assurance and industry relations, elaborates: “Ever since the start we’ve been growing so rapidly and changing so much that everybody who is here now is used to that kind of environment, where you take a vacation, you come back and you have to figure the place out again. Change is the constant around here.”

HEADQUARTERS: Portland FOUNDED: 1984 OWNERSHIP: Public (ticker HOOK), minority share (36%) owned by InBev/Anheuser-Busch CO-FOUNDERS: Kurt Widmer, now chairman; Rob Widmer, now VP CO-CEOS: David Mickelson (former president, Red Hook Ale Brewery) and Terry Michaelson (president of a joint venture between Widmer and Red Hook) EMPLOYEES: 550* PRODUCTION: 600,000 barrels* barrels REVENUES: growth every year other than 1997; flat in 2007 BRANDS: Widmer Hefeweizen, Kona Longboard Lager, Blackhook Porter NEW DEVELOPMENTS: Recently completed merger with Seattle-based Red Hook; unknown impact of InBev’s $52 billion purchase of A-B; eying future acquisitions * Figures include all four brewing companies affiliated with Craft Brewers Alliance. WEB EXCLUSIVE: READ FULL Q&A WITH THE WIDMER BROTHERS |

The newly formed Craft Brewers Alliance operates breweries in Washington, New Hampshire and Portland and holds minority stakes in Kona Brewing Co. of Hawaii and Goose Island Beer Company of Chicago. The move should lead to all sorts of synergies and economies of scale over time, but Kurt, 56, says first thing’s first: “So many of our people have been in deal mode for a long, long time. It’s nice to have them out of deal mode and back in beer-brewing and beer-selling mode, doing what they should be doing.”

The distribution partnership with Anheuser Busch has enabled Widmer to grow into a national brand that performs well in Northern Virginia, North Carolina and Southern California as well as the Northwest. It has also brought backlash from some beer purists who equate Anheuser-Busch with pure evil. Never mind that it has never had anything to do with how Widmer brews its beer.

The “too big to be micro” critique is clearly a sore spot for the brothers. In their view, their beer has gotten better as they have grown, due to equipment upgrades and competitive hiring for brewing specialists. “If people were saying our beer used to be good but it’s not good any more, then I would apologize for that,” says Kurt. “But it is very difficult to apologize for getting too big when the quality is better than it’s ever been.”

Besides, adds the 51-year-old Rob: “Compared to InBev, we are a speck.”

InBev took the podium as the largest brewer in the world when it annouced it will buy Anheuser Busch for $52 billion in July, not long after August Busch IV vowed no merger would occur on his watch. Whether that mega-deal will affect the Craft Brewers Alliance remains to be seen. For now the alliance has work to do. Red Hook lost money in 2007 and post-merger HOOK stock is selling for about half of what it was fetching a year ago. The craft brewers merger was completed amid an economic slump that has deflated consumer confidence and sent commodity prices soaring for the wheat that fuels Widmer Hefeweizen and the hops that give the Broken Halo IPA its bite.

But with a strong portfolio of brands under one umbrella and the ability to brew regionally to save on distribution costs, the alliance has great potential to grow, and to acquire more breweries. “Every now and then we get a call from someone who wants access to the A-B system,” says Kurt. “Not that we control that access, but they want to know how it works and things like that. It’s a remarkable system and, well, short answer: There may be additions down the road.”

Again, Rob elaborates: “Our customers want one-stop shopping. They want our salesmen to walk in and offer a lot of choices. They are national players and they want national distribution. That goes back to the excellent distribution system that A-B offers. You can do a program nationally with a keystroke.”

FULL SAIL BREWING

|

BACK FROM THE BRINK, FULL STEAM AHEAD

Irene Firmat stopped off at the Full Sail pub in Hood River midway through a busy day when a customer informed her that her brewery had been sold to Miller.

“I said, ‘No we haven’t,’” she recalls. “He said, ‘You guys are always the last to know.’ I said, ‘Wait a minute, I’m not just an employee. I started the company. I’m the CEO. If somebody was buying the company I think I would know.’”

Having politely put the rumor-monger in his place, Firmat returned to the daily task of keeping Full Sail healthy, profitable and independent. History has shown her that these things are not to be taken for granted.

Firmat, now 50 years old, came into brewing from a business background. She was a single woman opening a brewery in Hood River in 1988, when one resume among the stacks caught her eye: “Objective: To master the art and science of brewing.”

“I thought, ‘That’s my guy. That is perfect.’ And just to be truthful, we ended up falling in love and getting married and he’s now my husband.”

HEADQUARTERS: Hood River FOUNDED: 1987 OWNERSHIP: Employee owned CO-FOUNDER AND CEO: Irene Firmat EMPLOYEES: 83 PRODUCTION: 130,000 barrels GROWTH: more than 20% for each of the past three years. BRANDS: Full Sail Amber, Session Lager, Henry Weinhard’s NEW DEVELOPMENTS: Renewing a contract with MillerCoors to brew Henry Weinhard’s brands in Hood River, expanding distribution, brewing lighter beers WEB EXCLUSIVE: READ FULL Q&A WITH IRENE FIRMAT |

Ten years later, Full Sail’s board voted 4-2 to sell the company, with Firmat and her husband, brewmaster Jamie Emmerson, voting no. The top bidder was Vijay Mallya of United Breweries Ltd., who made it clear he was interested in the Full Sail brand — not the brewery. “For us to look people in the eye who had built the company,” she says shaking her head. “I couldn’t do it. They would have ended up with nothing.”

Firmat borrowed money to set up an employee stock fund and assemble a counter-offer. She and her husband personally guaranteed the loans. Their offer couldn’t compete with that of United Breweries, but when United pulled out one hour before the deadline, they had an opening. “Everyone was waiting in the pub to hear, and when we called and said it was a go, you could hear this scream rise up in the pub. It was incredible.”

That euphoria soon gave way to the daunting challenge of freeing the company from debt. Over the past decade, Firmat has steered Full Sail from the brink of disaster to steady growth through a combination of new products, new partnerships and a revamped brand image. She pushed for a craft-beer option for drinkers who prefer a lighter beer, and Full Sail’s Session Lager has been a critical and commercial hit. She also has renewed a contract with MillerCoors to continue brewing Henry Weinhard’s beers in Hood River, bringing back a legendary Oregon brand with broad appeal.

To reinvigorate the Full Sail brand, Firmat worked with Chris Riley, a brand consultant based in Portland who has done a lot of work for Apple. In one of the interviews Riley’s team conducted, a customer said she liked Full Sail but she didn’t like to buy products from large companies. The interviewer asked the customer what she considered large, and she said 500 employees. Firmat couldn’t believe it. She had told Riley Full Sail had about 50 employees, but a recount found 47. She reported to Riley and he started laughing. “You don’t know what 47 is?” he asked. She had no clue. “It turns out there’s a cult around the number 47,” she says. “If you Google it there’s a mathematician out of Oregon State who has done all this research on it; 47 is the most randomly used number in the world.”

Full Sail continues to print the most randomly used number in the world on its bottles, although that employee count becomes increasingly dated as the company grows. Between the success of Session Lager, the solidity of the Henry’s contract and Full Sail’s new push to gain market share on the East Coast, Firmat sees plenty of room for growth.

“We live in a place where people’s expectations of flavor and freshness and buying local are deeply embedded,” she says. “We take this for granted. But on the East Coast it is cutting edge. The thing we always talked about when we started the brewery was, this is not a fad. This is a core trend on how people drink.”

Have an opinion? E-mail [email protected]

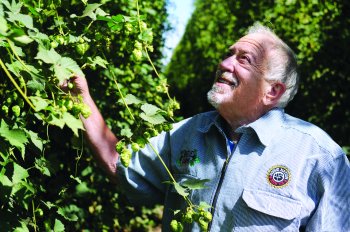

GARY FISH has built Deschutes Brewery into the top craft beer seller in Oregon. He is weighing options for taking Deschutes national.

GARY FISH has built Deschutes Brewery into the top craft beer seller in Oregon. He is weighing options for taking Deschutes national.