Brand Story – By May 2020, all Oregon businesses must offer employee retirement programs — both missteps and opportunities await.

Retirement plan pioneer Ted Benna designed the ultimate industry game changer — the 401k — by getting creative with the untapped opportunities hidden in the IRS code. Forty years on, he is at it again as Oregon moves to establish obligatory employee retirement plans in every business, no matter the size.

In 2017, spurred by the reality that between 40% and 50% of workers had no retirement programs available, the state began ordering that employers with more than 100 staff members offer them.

A few years later, it ratcheted down to include companies with more than 50 employees. This May, it dropped again to companies with between 10 and 15 employees. Soon, that mandate will cover companies with between five and nine employees, and between one and four come spring. Next year Oregon will join a short list of states in which all employers, big and small, will be required to offer retirement plans. A fine of $100 per employee with a maximum of $5,000 also becomes effective in Oregon January 1, 2020. This means all Oregon employers regardless of size will soon have to either have a plan or pay a fine.

Large companies with longstanding 401Ks will hardly notice the change. But what about family businesses, startups, entrepreneurs, single-person LLCs and any company with fewer than 15 people? Even the architect himself would argue that the 401K was not designed for them.

“401Ks are too complex and expensive for most small employers. As the guy who started it, I totally agree,” says Benna, founder of Benna401k and author of multiple books, including 401k for Dummies and 401k — Forty Years Later. “You’ll see articles about how small businesses or solo entrepreneurs don’t really have options available and it blows my mind because they have so many.”

Benna401k, LLC is a consulting firm that offers advice to small companies and startups on setting up employee retirement plans. After paying a nominal fee ($50) companies receive information about the four different models to help them decide which one may be most appropriate. Additional support is available to help set-up the plan.

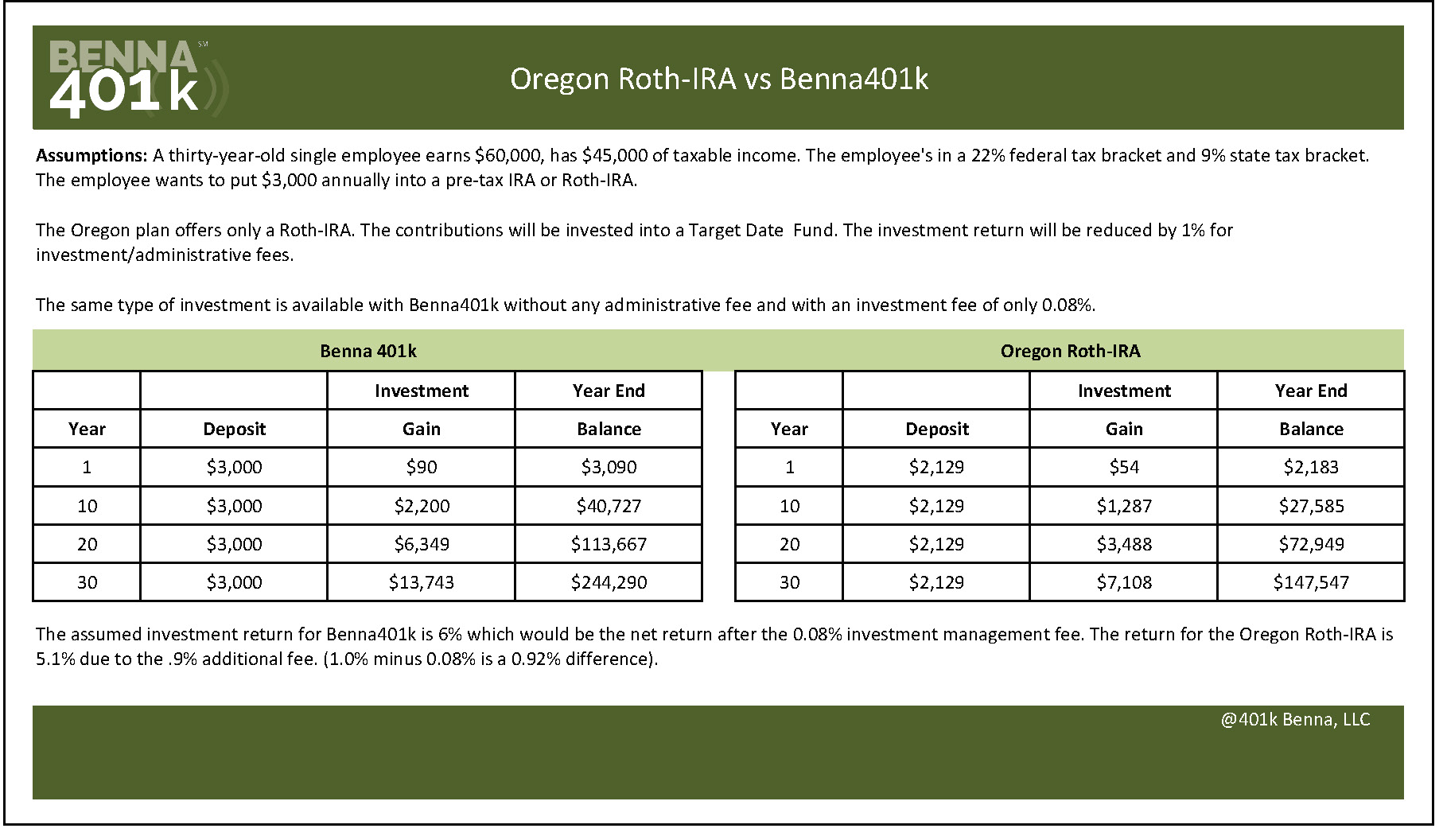

Many small businesses will automatically turn to the state-run program before learning about alternatives available. First, it’s important to realize that Oregon’s state program only offers a Roth IRA, resulting in more current tax revenue. But more on that later.

Next, Benna is a longtime critic of high fees. “The excessive fees really bug me,” he says. “Why should savers pay one percent for the same thing they can get for 0.08 percent? In my opinion the higher fees are not justified.”

The following example shows how much faster someone’s account will grow by making contributions to a pre-tax IRA with lower fees rather than an Oregon Roth IRA.

Lastly, state plans are one-size-fits all, offering a fixed menu of investments and no avenue for employer contributions. Benna401k’s models present employers with four paths with an array of investment options. Which model will be most appropriate hinges on multiple factors, including how much the owners want to contribute, how much if any employer matching contribution will be contributed, etc.

Lastly, state plans are one-size-fits all, offering a fixed menu of investments and no avenue for employer contributions. Benna401k’s models present employers with four paths with an array of investment options. Which model will be most appropriate hinges on multiple factors, including how much the owners want to contribute, how much if any employer matching contribution will be contributed, etc.

Creative Freedom Within IRS Code

As a life-long retirement plan consultant, Benna won the Investment News Innovator Icon Award for his creative mastery of IRS code and the solutions he has grown out of it: “Early on in my career, I had the opportunity to uncover ways of doing things in this space that generally weren’t being done by others. I began realizing that there was more potential in sections of the law or IRS code than what was otherwise being considered.”

Benna’s 401k breakthrough came by homing in on what the code might allow, rather than what it forbade. He added two features not explicitly prohibited: employer matching and employee pre-tax contributions. Just like that, retirement for the average American was forever changed and the stage was set for the rise of today’s booming mutual fund industry.

“Seeing younger employees who have become savers and wouldn’t have otherwise is really rewarding. I’ve had many participants over the years thank me for the 401K,” Benna notes.

Transparent, Simple & Compliant

Across Oregon persists the common misconception that employers only have limited options. If a plethora of better options exist, why are they consistently overlooked?

Benna highlights the root of the problem: “There’s not enough money in this for the financial community. A small employer that will be putting in $20,000-30,000 a year is worth nothing for a financial advisor. So they don’t market to that audience. That’s why the mandate is important, and I give Oregon credit.”

As of now, 10 states are moving in the same direction as Oregon, ordering more and more employers to offer retirement plans to their employees. The big question remains whether or not the move will happen on a federal level.

Luckily, employers can take control now, get compliant and, best of all, easily set themselves and their employees on the track to long-term financial wellbeing.

Benna401k, LLC wants employers of all sizes to know their options. Once they do, the right path becomes clear.

Employers considering Benna 401k should explore the Oregon option at benna401k.com. For a $50 fee, they will receive information about each model, helping them determine which one is best suited for their needs. For the full $250 fee (reduced to $200 if the initial $50 was paid) employers can retain Benna401k, LLC to help implement one of the models – benefiting from the information and resources needed to set up the plan, as well as any necessary technical support.

Ted Benna on CNBC : photo credit Scott Mlyn, CNBC

Ted Benna on CNBC : photo credit Scott Mlyn, CNBC

The Problem With Roth

As new legislation obliges smaller and smaller companies to offer retirement plans to employees, state-run plans, like OregonSaves, emerge. States only offer Roth-IRAs, shaping the public misperception that they are somehow superior to pre-tax options. Benna401k, LLC wanted better, so when designing models it knew that pre-tax versions were essential.

“First off, it makes no difference to me personally if people choose a Roth or a pre-tax IRA,” Benna clarifies. “But I’m always surprised how many people automatically choose a Roth simply based on the belief that taxes might be higher when they retire.”

Tax rates are in fact lower today than they were when the Roth IRA was enacted in 1997. Therefore, most individuals who invested in Roth IRAs since then would have done better by using a pre-tax option. Also, most retirees have less taxable income than they did during their working years.

Benna’s advice? Choose a pre-tax option. The tax savings will enable you to grow your nest egg much faster given that the future presents a host of unknowns: injury, policy changes, marital status, employment and more: “Disruptions are a fact of life, so I strongly recommend building your nest-egg faster rather than slower.”

Know Your Options

Main Street, USA, in Oregon and beyond is lined with small businesses living on lean margins. While large organizations can afford unnecessary fees, this hardworking majority cannot and, according to Benna, should not. Rather than automatically opting for state-funded programs, know the full story and the generous options available.

“We are offering business owners, employees and entrepreneurs a path to retirement that surpasses what they have available. Give yourself and your employees a better deal,” says Benna.

For more information, please call 877.890.1223 or visit benna401k.com.

Brand stories are paid content articles that allow Oregon Business advertisers to share news about their organizations and engage with readers on business and public policy issues. The stories are produced in house by the Oregon Business marketing department. For more information, contact associate publisher Courtney Kutzman.