Brand Story – Local firm emerges as nationwide expert in generating significant passive income streams for investors.

Investing to create a passive income stream is nothing new — think real estate, bank loans, mortgages, bonds and dividend paying stocks. But today’s low interest rates and investment payouts leave income investors — from retirees to foundations to pension funds –struggling to achieve the cash flow once possible through money market funds, CDs and T-Bills.

Enter Matisse Capital, which runs two income-focused mutual funds, the $314M Matisse Discounted Closed-End Fund Strategy (MDCEX) and the $24M Matisse Discounted Bond CEF Strategy (MDFIX) launched mid-pandemic. We sat down with the Lake Oswego-based fund manager to discuss its funds and why investors searching for more income might consider MDCEX or MDFIX.

Q: Matisse runs two mutual funds. Can you give us the Cliff Notes on what exactly they do?

MDCEX and MDFIX are both no-load, open-end mutual funds that make investments into discounted closed-end funds (CEFs). So, both funds are considered “fund of funds”.

Both funds pay out quarterly dividends, which include income earned and any capital gains. Fund distribution history can be reviewed on https://matissefunds.com/.

There are some other key differences between the two:

– Invests in both equity and fixed income CEFs

– Morningstar category: Tactical Allocation

– Inception: 10/31/2012

MDFIX

– Only invests in fixed income CEFs

– Morningstar category: Multisector Bond

– Inception: 4/30/2020

Q: Closed-end funds are at the heart of MDCEX & MDFIX. Can you explain how they work?

Certainly — both our funds invest in CEFs that (1) trade at significant discounts to their Net Asset Value (NAV); and (2) pay regular periodic cash distributions.

CEFs enable our Funds’ high income potential, so it’s important to understand how they function. Typically bought and sold on the New York Stock Exchange, there are almost 500 CEFs in existence today, with a total market cap of approximately $240B. Most are professionally managed for income and make regular payouts on a monthly or quarterly basis.

Our research-driven approach quantitatively scores and ranks every CEF in real time, and our proprietary model helps us make investment decisions and optimally manage both Funds’ investment portfolios.

We aim to own CEFs that score high both fundamentally and quantitatively, which we believe gives our shareholders the best potential for high income and capital gains.

Matisse Capital’s offices in Lake Oswego

Matisse Capital’s offices in Lake Oswego

Q: How have the Funds performed?

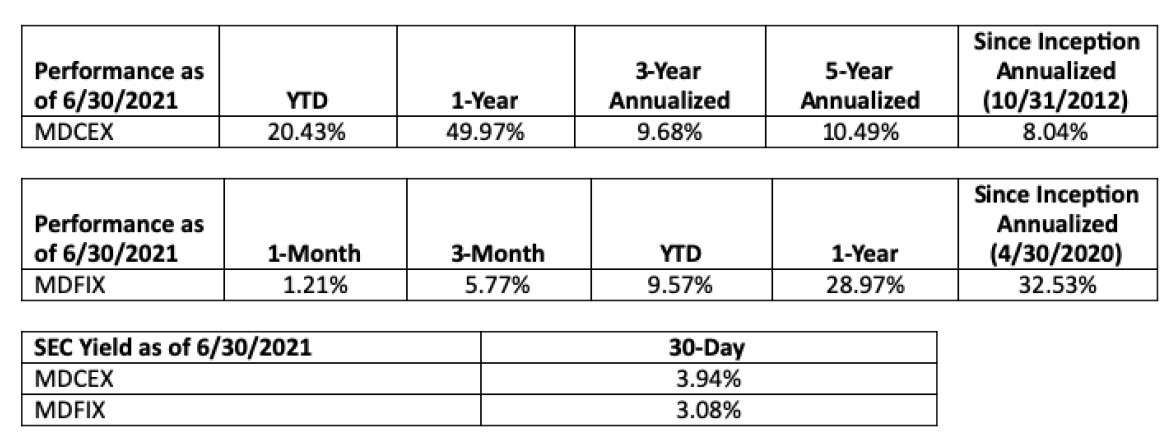

Since its inception on October 31, 2012, MDCEX has produced an annualized return of 7%, all of which has been returned to shareholders in the form of cash distributions (as of 2/28/2021).

Since its inception on April 30, 2020, MDFIX has produced a total return of 29%, with 5% coming in the form of cash distributions (as of 2/28/2021). The remaining portion of its return has primarily come from a combination of both beneficial discount movement and underlying NAV appreciation of MDFIX’s holdings.

Q: What kind of income payouts can shareholders expect when they invest in one of your Funds?

Both MDCEX and MDFIX pay out quarterly dividends and annual capital gains distributions. As mentioned, MDCEX has historically paid out more than 5% in annualized cash distributions, and MDFIX has historically paid out 6% in annualized cash distributions.

In 2020, MDCEX paid out 9% in cash distributions. For example, an investor who purchased $1M of MDCEX on January 1, 2020 and elected not to reinvest dividends and capital gains would have received $90,000 in passive cash flows (including dividends and capital gains) for the entire calendar year.

For an investor who purchased $1M of MDFIX on its inception of April 30, 2020 and elected not to reinvest dividends and capital gains, this investment would have generated a total of $47,000 in passive cash flows for the last 8 months of 2020 (an annualized rate of 6%).

No level of cash distribution is guaranteed, but MDCEX and MDFIX are required to pay out all income and capital gains we receive from our CEF positions to shareholders annually. As a shareholder, your investment principal will fluctuate both upwards and downwards in value over the life of your investment. However, with the Funds’ unique ability to generate and distribute cash, we believe both MDCEX and MDFIX should be part of an investor’s income portfolio.

Q: Interest rates are at historic lows, and T-bills are paying less than 10 basis points (0.1%) today. How can you target such high distribution rates?

It sounds too good to be true, but it isn’t. Both MDCEX and MDFIX make investments into CEFs, which are professionally managed vehicles that offer the potential for higher regular income because of their distinct structure and ability to use leverage. Historically, they have been very popular income investments. All else equal, as the discount on a CEF increases, its cash distribution rate also increases. Investing in CEFs trading at significant discounts to NAV helps us maintain a relatively high cash distribution rate for our shareholders.

To make a real estate comparison, think of investing in an undervalued rental income property. Our concept is similar, but instead of real estate with very little liquidity, we’re investing in vehicles that have daily liquidity.

Q: Who can invest, and how?

Both MDCEX and MDFIX are available for investment on most trading platforms (Charles Schwab, TD Ameritrade, Fidelity, etc.). If you have an investing account, just search for our tickers as if you were making a new trade.

We maintain low investment minimums ($1000) on both of our funds so that most investors can access the same knowledge, expertise and boutique income strategies that we would otherwise only provide to larger accounts with a minimum of $25M.

Q: Why are MDCEX and MDFIX both “fund of funds”?

Both funds are considered a “fund of funds” which means they do not invest directly into individual stocks and bonds. Instead, we invest each Fund’s assets into discounted CEFs managed by firms like Nuveen, BlackRock, PIMCO, Legg Mason, Franklin Templeton and JP Morgan, to name a few. We believe this approach gives us an advantage and allows us to cheaply invest into some of the best equity and fixed income fund managers in the world.

From a diversification viewpoint, there is a CEF for virtually every investment style or box in the market. We can access fixed income CEFs specializing in high yield, municipal bond, foreign bond, bank loan, investment grade and preferreds. In the equity market, we can access CEFs in MLPs, technology, health, covered calls, blue chip, growth, value, foreign, emerging markets, Asia-Pacific and more. We could never be a specialist in all of these things, but our strategy allows us to buy professionally managed CEFs in these areas, usually at tremendous bargains. The result for our shareholders is a highly diversified underlying portfolio that we actively manage, making trading decisions as CEF discounts move organically.

Q: What is Matisse’s management fee?

Understanding the fees you pay in a “fund of funds” can be confusing, and the SEC requires that the operating expense of both MDCEX and MDFIX includes the operating expenses of their underlying holdings. The bottom line is that we cap our direct management fee on MDCEX at 0.99% and MDFIX at 0.70%, and the direct cash expense an investor pays is limited to a maximum of 1.25% for MDCEX and 0.99% for MDFIX.

Q: What makes Matisse Funds different from other mutual fund offerings?

Not many investment firms specialize in CEFs, which is our unique value proposition. In today’s market, we believe both MDCEX and MDFIX should be able to produce significant passive cash flows for investors, who can then choose to reinvest their cash flows and benefit from potential future compounding, or have this cash linked and sent directly to their checking accounts. Ultimately, we want to help investors create passive income streams that require little-to-no effort on their part.

Matisse Capital’s state-of-the-art conference room is well equipped for Zoom meetings.

Matisse Capital’s state-of-the-art conference room is well equipped for Zoom meetings.

Q: What makes MDFIX unique compared to other fixed income mutual funds?

First, to our knowledge, MDFIX is one of the only products on the market that strictly invests in fixed income CEFs. Its investment universe includes CEFs that specialize in high yield, municipal bond, foreign bond, bank loan, investment grade and preferreds.

Second, because we purchase deeply discounted CEFs, MDFIX should typically generate higher cash distributions than other fixed income funds.

Third, and possibly the most important difference, is that we have a true, identifiable source of potential capital gains that aren’t available outside of the CEF market. Our studies show that individual CEF discounts hover around a mean. When they are significantly lower or higher than normal, our research shows that they typically revert to their mean discount within 12-24 months. MDFIX invests in fixed income CEFs that trade well below their average discounts, so that when any mean reversion occurs, we can potentially capture capital gains for our shareholders and generate extra return — in addition to the income we pay out.

This return source is unique to the CEF market. Virtually all the larger fixed income funds do not access this return source because they choose not to invest in CEFs. Larger fund managers typically avoid CEFs because (1) by prospectus, CEFs aren’t included in their funds’ strategies and (2) even if CEFs were included, most funds’ assets are too large to participate in our niche market. For example, look at American Funds’ $71.4B Bond Fund of America (ABNDX), Vanguard’s $70.3B Total Bond Market Index Fund (VBTIX), and DoubleLine’s $50.9B Total Return Bond Fund (DBLTX). We believe it would be mathematically impossible for these funds to trade enough capital into and out of the $240B total market cap in CEFs to even influence their funds’ returns at that asset size.

On the other hand, our team believes we can comfortably manage up to $1B in CEFs before we consider closing our Funds to new investors.

MDCEX and MDFIX are available for investment on most online brokerage trading platforms. Those interested can reach out to [email protected] or visit https://matissefunds.com/ to learn more.

Returns longer than one year are annualized. Performance data quoted is past performance, which is not a guarantee of future results. Current performance may be lower or higher than the performance data quoted. An investment’s return and principal value will fluctuate such that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Performance current to the most recent month end can be obtained by calling 1-800-773-3863. Performance shown assumes reinvestment of dividends and capital gains distributions. Total Fund Expenses are 3.48% for MDCEX (as of August 1, 2020) and 3.24% for MDFIX (as of April 3, 2020).

An investor should consider the investment objectives, risks, and charges and expenses of the Funds carefully before investing. The prospectus contains this and other information about the Funds. A copy of the prospectus is available online at www.ncfunds.com or by calling 1-800-773-3863. The prospectus should be read carefully before investing.

An investment in the Funds is subject to investment risks, including the possible loss of some or all of the principal amount invested. There can be no assurance that the Funds will be successful in meeting their investment objectives. Generally, the Funds will be subject to the following additional risks: Closed-End Fund Risk, Fund of Funds Risk, Control of Portfolio Funds Risk, Fixed Income Securities Risk, Credit Risk, Interest Rate Risk, Junk Bond Risk, Prepayment Risk, Derivatives Risk, COVID-19 and Other Infectious Illnesses Risk, Convertible Securities Risk, Cybersecurity Risk, Equity Securities Risk, Foreign Securities Risk, General Investment Risks, Investment Advisor Risk, Quantitative Model Risk, Leverage Risk, Limited History of Operations Risk, Loans Risk, Management Style Risk, Market Risk, Money Market Mutual Fund Risk, and Portfolio Turnover Risk. More information about these risks and other risks can be found in the Funds’ prospectus.

Distributor: Capital Investment Group, Inc., Member FINRA/SIPC. There is no affiliation between Matisse Capital, including its principals, and Capital Investment Group, Inc. Serial #RCMAT0621013

Brand stories are paid content articles that allow Oregon Business advertisers to share news about their organizations and engage with readers on business and public policy issues. The stories are produced in house by the Oregon Business marketing department. For more information, contact associate publisher Courtney Kutzman.