Brand Story – Embracing client education & operational discipline for long-term growth.

Near the end of 2018, the financial markets fell hard, dropping nearly 20% in a month. Investment managers across the country scrambled to calm clients ready to run for the hills. But at Rutherford Investment Management, it was relatively quiet.

Why did such market turmoil result in just one client phone call and one email instead of mass hysteria? The answer lies in the proven wealth management approach the firm has employed for 25 years, starting with client education.

“If there’s an event that occurs, and I’ve done my job, clients don’t panic,” explains William Rutherford, founder and President of Rutherford Investment Management. “I’ve never thought of myself as a teacher, but I guess that I am.”

Though time consuming, client education is central to a firm that revolves around the long term – a theme visible in its stock selection process, client relationships, established team, not-for-profit work and, perhaps most clearly, in its mission: “Investment management for the long-term investor.”

As with most accomplished teachers, Rutherford is first and foremost a student. In second grade, his teacher gave him the key to the school library and an open invitation to explore, which he seized every opportunity to do and still does.

A lifetime of public service later – including positions in the U.S. Army, in the Oregon House of Representatives, as Chairman of the Oregon Investment Council and as Treasurer of Oregon – as well as a successful career leading and advising large international financial institutions, he still remembers when his father introduced him to the stock market.

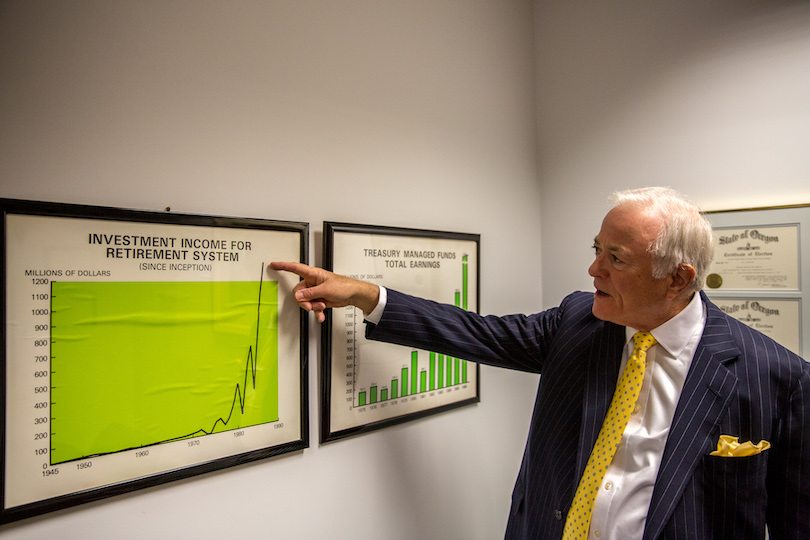

William Rutherford points out the PERS investment returns during his term as Treasurer of Oregon.

William Rutherford points out the PERS investment returns during his term as Treasurer of Oregon.

For a young boy living in McMinnville, Oregon, and earning a silver dollar a week working in the family store, the concept of making money while sleeping seemed worth looking into. By 10 years old, he had saved up $200 and bought stock in his first company.

“I learned that it wasn’t how strong you are or how fast. It’s about being effective, efficient and having a disciplined process,” says Rutherford. As State Treasurer, he steered Oregon into international equity investing, something no U.S. public fund had previously done, thereby becoming a model for other states. When he left the position, the Oregon PERS was substantially overfunded and well positioned to remain so, a result of the disciplined approach that Rutherford brings to every endeavor. All clients receive the same institutional quality process he utilized in the Treasurer’s office and at the investment firms he subsequently established for prominent European banks.

Being disciplined sometimes means taking the road less travelled. Take 2007, when Rutherford was criticized during a CNBC interview for his decision to sell bank stocks, which happened to be strong that day. Within a year, some were down 90%, becoming worth less per share than a cup of coffee.

“What sets the firm apart is that combination of owner/operator business experience and international investing background. Having had offices in Tokyo, London, Paris and Frankfurt, Rutherford has investment experience that’s pretty much unparalleled in Oregon.

That’s what keeps the investment style consistent during good times and bad,” adds Joan Lamb, Executive Vice President and previously a managing director with Merrill Lynch Capital Markets and head of its emerging growth corporate finance activities in Southern California.

Since it was founded, Rutherford Investment Management has chosen to have its annual returns verified by a third-party accounting firm that adheres to Global Investment Performance Standards (GIPS), something most organizations opt out of due to expense.

“I can look across the table, look you square in the eye and confidently tell you what our historical performance numbers are. Clients are getting the quality of investment execution and reporting that I expected from my advisors when I was Treasurer of Oregon, running one of the largest pension funds in the country,” says Rutherford, who brings a uniquely macro point-of-view to Portland.

Even as the firm has grown, the leadership team, consisting of Rutherford, Lamb and Chief Operating Officer James Ulatowski, who has been with the firm for 21 years, maintains a boutique spirit, paying close attention to each client.

Joan Lamb, executive vice president, meets with William Rutherford.

Joan Lamb, executive vice president, meets with William Rutherford.

Superior client service goes hand in hand with financial growth. Through regular meetings and ongoing communication, clients grow not only their assets, but also their investment prowess.

“We sit with them regularly and work through their financial priorities and concerns,” adds Lamb. “In addition to 401K plans and foundations, we deal with single people, young and old, helping empower them with their finances, and couples, getting them on the same page, since they may have different risk profiles or market understanding.”

A fiduciary with a responsibility to put the client first and a fee structure that eliminates any conflicts of interest, the firm proudly still serves its original, day-one clients.

Rutherford’s allegiance to the “long term” and his palpable optimism extends into the not-for-profit sector, including a fund set up to aid in protecting Cascade Head, a prominent geographical location on the Oregon Coast that sees 30,000 annual visitors. Equally forward thinking was the creation and funding of an initiative at the University of Oregon that resulted in the creation of a minor in Middle Eastern studies. Rutherford’s mission with the popular program was to build a bridge of understanding among cultures to facilitate mutual problem solving.

A philosophy weaves throughout all of these activities: from supporting schools, end-of-life palliative care, and Portland and McMinnville music programs, to operating variety stores in rural Oregon towns, running a law firm, serving in the Oregon legislature, manning a small farm or raising two children. In both finance and life, that philosophy harnesses the long-term power of education, process and unwavering focus.

Rutherford and his team view service and work, not as a sacrifice, but as the fountain of youth: “We stick with it because it’s rewarding to help people realize their individual goals,” he concludes. “And it keeps one young. We often see people retiring too early and trying to fill their time. I’d rather be managing investment portfolios.”

Brand stories are paid content articles that allow Oregon Business advertisers to share news about their organizations and engage with readers on business and public policy issues. The stories are produced in house by the Oregon Business marketing department. For more information, contact associate publisher Courtney Kutzman.