A Q&A with Bend craft brewer John Glick.

John Glick has worked for large breweries most of his career. He spent 19 years at conglomerate Anheuser-Busch in St. Louis and the past seven years at Craft Brew Alliance in Portland, where he was responsible for scouting out potential acquisitions of small regional players. Now he has done a 180, becoming the new CEO in April of a small craft brewer in Bend, Worthy Brewing Co.

Glick talked to Oregon Business about how consolidation is changing craft brewers’ identity, how beer tastes are evolving and why breweries are keeping a close eye on cannabis consumers. (This interview has been edited for length and clarity.)

OB: Consolidation has swept the craft brewing sector. Is it losing its identity as a small, niche craft-based industry?

JG: I would say the craft brewers’ identity is getting murky. The bigger brewers are seeing the small craft brewers are winning in the marketplace with the consumer. They have said, “If we can’t beat them let’s join them.” And so they have started buying up the small craft brewer. They want to continue to put the brand in front of people and say this beer is local. But on the back side of things they are brewing the beer in larger facilities at lower cost, and brewing out of state, and in some cases many states away.

I have worked at the large brewers. They are public; they have shareholders you have to worry about. It is about getting them a return. At Worthy, it is about making really good beer, running a good business and developing relationships with the consumer and also in the community. It is grassroots, like running a family business people can trust.

OB: Bend has a lot of craft breweries. How do you stand out from the crowd?

A. At Worthy our mantra is, “It is all about the hops.” We stand out because we have a relationship with Oregon State University in developing unique hops that other people don’t have access to. We have a relationship with Indie Hops, which is a craft hop grower and processor in Portland. We are not owned by a large brewer. Our company doesn’t have a bank we have to worry about. It is about the beer and making the best beer we can make.

OB: Is the Bend craft-brewing market too saturated?

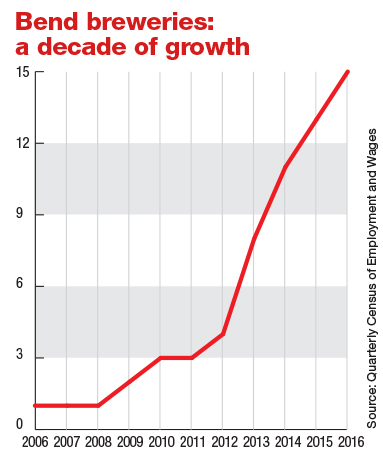

JG: I don’t think so. It is unique in that it has so many breweries in it. There are so many tourists and people who flock to Bend for the weather and outdoor adventure. And they come for the breweries and the food. That is part of the culture. I think everyone is trying to find their niche and try to differentiate themselves. The day of more breweries and craft breweries growing at a phenomenal pace is probably over. Do I expect more breweries in Bend? Probably not. The breweries that are here are all well run and have some really nice beers. People will figure out how they can continue to sell more beer. If the beer business is not growing and craft brewing slows down, we have to continue to work on how we source consumers.

OB: A lot of marketing of craft beer targets young white men. Does the way craft brewers market themselves exclude other demographics?

JG:. The craft brewers have struggled to find a product that reaches across genders. We would love to sell more beer to women. When you look at demographics you try to understand who is buying your product. I can’t speak to ethnicity – but young men drink beer more than women. It is a statistical fact. It has been that way for ages. Brewers in general have tried to find ways to cross that boundary and find a product that is more interesting to women and work out how to market to women. Frankly, not many have been successful. I don’t think there is an intentional marketing toward men, but definitely the skew of who is buying beer is 21 to 27-year-old men.

OB: How do you see the craft brew sector evolving over the next five years?

JG: It will continue to innovate with recipes and products. IPAs are big today because there was a pendulum that was swinging from domestic lagers that are really easy to drink to beers that are more full flavored, hoppier and more bitter. The trend today is to moderate that. You see that with fruit additions, which minimize the bitterness. We are also seeing lighter beers and riffs on pale ale.

Full Sail has come out with a hard kombucha — above the alcohol limit you see from Humm and those folks. They are providing beverages that people like to drink that have some alcohol in them. Over the next three to five years, you will have more beer that is full flavored, unique, has a story and is also sessionable, meaning you can have two or three in an evening without it filling you up and being overpowering.

OB: What impact will the cannabis sector have on craft brewers?

JG: The effect of legalization is what a lot of craft brewers talk about. People are talking about how those two products interact. Some people say it is actually helping beer sales — that consuming cannabis accelerates their interest in alcohol. Others think cannabis is a substitute. Some of the bigger brewers are trying to find out what is the young person’s portfolio of products when they go out as a group; also, what will happen to state and federal regulatory approval of those products. The craft brewer is looking at how to navigate through that and what the consumer is looking for: How can we have our product be complementary or use it as an opportunity to evolve social events in the future?

OB: How do you see the craft beer distribution model evolving?

JG: When brewers sell beer to a consumer in their own pub, they make full margin on that beer. That is the most profitable beer you will sell, because you don’t have a wholesaler who takes some of the margin, and there is no retailer who has some of the margin. The number of breweries that only sell at their pub will increase much faster than breweries that sell through a wholesaler and retailer because of the economics of that business model. Most of the breweries that have opened in the last few years are just brewpubs. They brew and sell their own beer. They don’t package it and sell it to a wholesaler and retailer.

OB: What is Worthy’s distribution model?

JG: Worthy sells about 1,500 barrels at its pub. That beer has the highest gross profit. But we also sell beer through Columbia Distributing, our wholesaler in Oregon. They help us sell to grocery stores and bars and restaurants outside of our brewery. That was the model when Worthy was started and craft breweries were growing. It was okay to make less money on that barrel of beer sold to a wholesaler because you were growing.

The model is evolving. As people become hyper local, and the growth at those wholesalers and in those retail spots slows down, you will find people and brewers staying closer to home and reinvesting in their own facility, and their own pubs and restaurants.

A version of of this article appears in the June 2018 issue of Oregon Business. Click here to subscribe.