Overtime regulation changes require employer review, pay adjustments, for employees

In Oregon, most employees are non-exempt and are paid overtime when they work more than 40 hours in a workweek. The rest are exempt from overtime and are instead paid a salary for all hours worked. Employees in both groups have been vocal about being underpaid and the Oregon Legislature and the U.S. Department of Labor (DOL) have responded by increasing the minimum wage at the state level and making it more difficult to claim overtime exemption on a nationwide basis.

Increased Costs for Non-Exempt (sometimes referred to as “Hourly”)

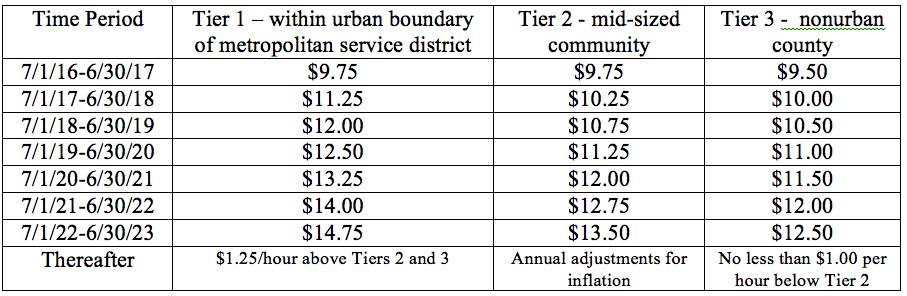

WorkSource Oregon has changed the minimum wage levels by creating a three-tier structure based roughly on population density, and has called for annual increases in each tier, the details of which are still being clarified. We anticipate more detailed information will be released soon. Beginning July 1, 2016, many Oregon employers will need to adjust employee pay as the minimum wage will increase in most areas to $9.75, and this is just the beginning. The chart below illustrates the changes within the tiers:

In addition to planning and budgeting for increased payroll costs, Oregon businesses may also be confronted with the problem of “compression.” This occurs when the lowest-paid employees receive increases but the higher-paid employees do not and the gap between the lowest- and highest-paid employees closes. This can lead to pressure to grant additional raises to maintain historic wage differences, or perhaps even the loss of long-time employees who feel devalued. Given this, planning for the minimum wage increase may involve more than just adjusting your budget to provide increases for employees at the low end of the pay scale.

Increase Costs for Exempt (sometimes referred to as “Salaried”) Workforce

On May 18, 2016, the DOL released a Final Rule amending the Fair Labor Standards Act (FLSA) regulations regarding overtime for most exempt employees. The requirements imposed by the changes will likely result in the reclassification of thousands of Oregon employees as nonexempt, thereby triggering payment of the increased minimum wages and, more importantly, entitling the newly reclassified employees to overtime pay at one-and-one-half their hourly rate when they work more than 40 hours in a week. The Final Rule takes effect on December 1, 2016.

The most significant change within the Final Rule is raising the Minimum Salary Level (MSL) for the white collar—executive, administrative and professional—exemptions from $455 per week ($23,660 per year) to $913 per week ($47,476 per year). This means that all exempt positions paying less than $47,476 must be evaluated to determine if a salary increase to the new MSL is warranted or if the position should be reclassified to non-exempt. In making this decision, there are at least two questions you should be asking in addition to the obvious – can you absorb the immediate impact of increases in salaries that are currently below $47,476?

First, Can You Afford the MSL When (Not if) it Rises?

In addition to absorbing potential increases in salary for the doubling of the MSL at the end of the year, employers need to consider the future consequences. The Final Rule contains a mechanism for automatic increases in the MSL every three years, based on indexing of salary levels in the lowest wage census region (currently the south region, which ironically includes high-wage Washington DC). The indexing factor makes it more difficult to predict how significant a future increase will be.

Second, Can You Take Advantage of Bonuses or Commissions You Would Pay Anyway?

The Final Rule allows certain additional compensation — including nondiscretionary bonuses, incentive payments and commissions — to satisfy up to 10% of the MSL. To qualify, exempt employees must receive at least $821.70 every workweek (90% of the MLS) in order to use the additional compensation amount. If, at the end of a quarter, the salary plus the additional 10% contribution from bonus and commission wages does not equal $913 per workweek, a one-time shortfall payment can be paid no later than the first pay period following the end of the quarter. If a shortfall occurs and a payment is not made, overtime is then owed for hours over 40 per workweek in the corresponding quarter.

Final Thoughts

Employers should review the current salary levels and compensation plans for all exempt employees to assess whether the new salary requirements are met. If employees are reclassified, employers should also develop comprehensive guidance to: (1) determine new hourly rates for impacted employees; (2) revise or update current timekeeping programs and policies to reflect the changes; and (3) implement training for both managers and employees addressing the changes.

Tamsen Leachman is a Shareholder in Littler Mendelson’s Portland office.