Recent market activity prompts us to consider Mark Twain’s famous quote — and revisit historical trends to understand how equities might perform for the remainder of 2018.

As investment managers, we do not invest by the calendar; however, history can be instructive.

Rocka Rolla

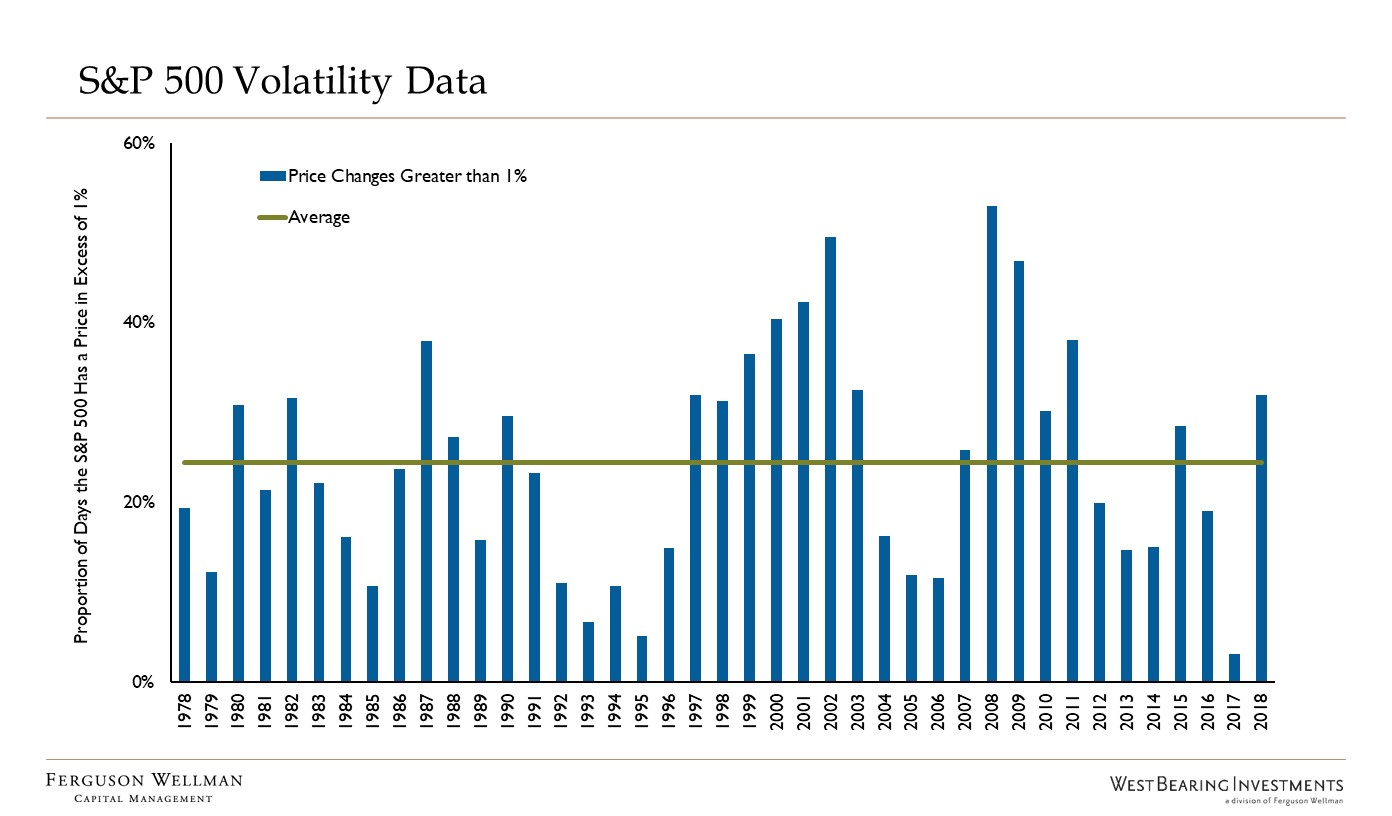

Stock market volatility is back with a vengeance, at least that how it feels. Volatility has increased with inflation fears, trade wars and geopolitical challenges. But without a doubt, these recent market swings are in line with history. The chart below summarizes what percent of trading days for the S&P 500 experience price swings in excess of 1%.

Source: FactSet

Historically, stocks close up or down more than 1% one out of every four trading days. This year it’s been about one-third of the time; however, unusually-low market volatility over the last few years has lulled investors into a sense of complacency. Volatility is back, but don’t expect much more than the historical average.

Summertime Blues

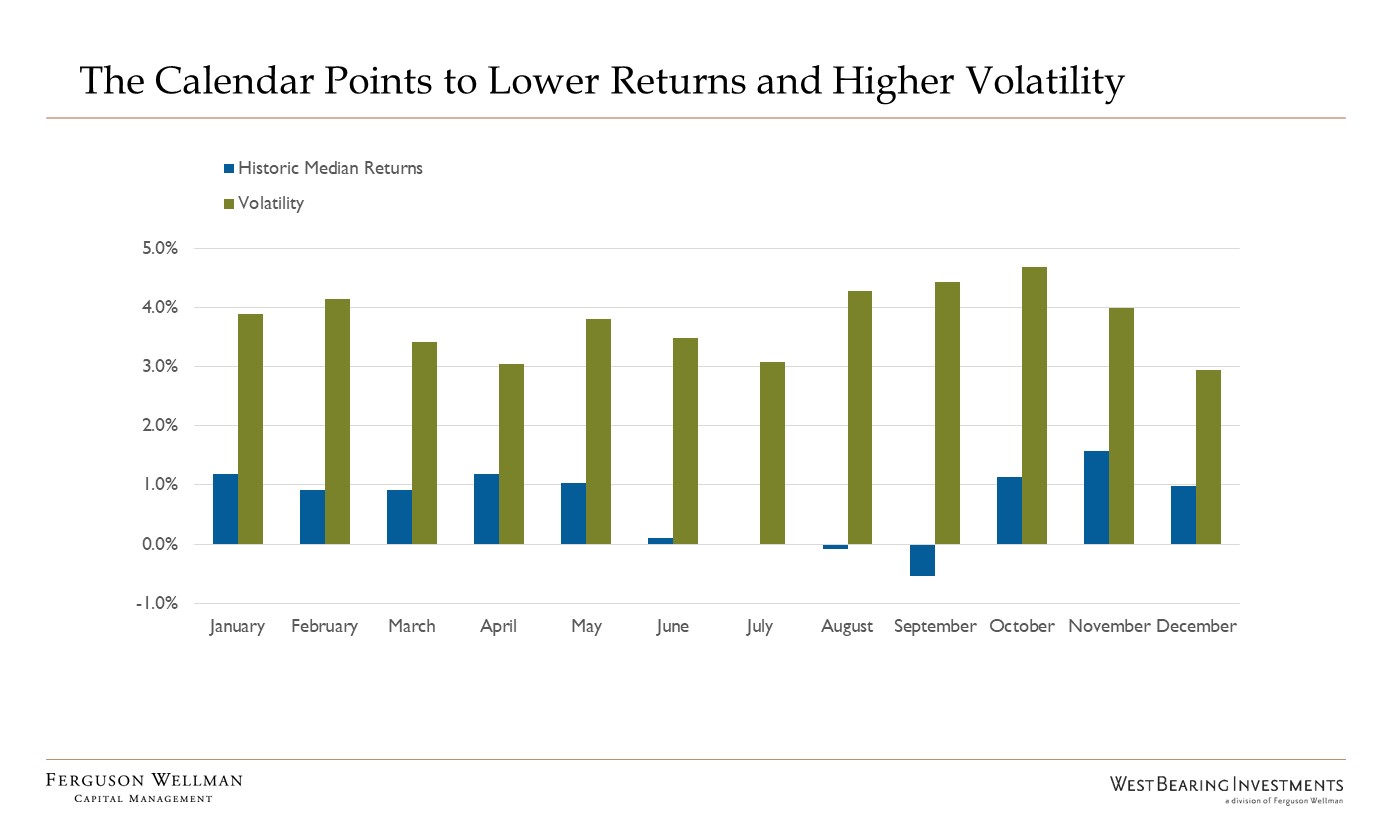

There’s an old adage on Wall Street called: “Sell in May and Go Away.” As we move toward summer months, returns are harder to find. Thus the theory that it’s better to get out of the market and come back in the fall.

Although May historically hasn’t been a bad month, June through September has in fact been a difficult period in the past, as seen in the chart below showing data from 1960 to 2017.

Source: FactSet

Returns tend to be lower than other months, and volatility heightened at the end of the summer. We certainly do not endorse selling equity positions for the summer since there will be periods when history doesn’t rhyme. In 2017, the “summer doldrums” produced 4%+ returns with low volatility. It’s tough to time the market, and long-term investors should focus on the finish line, not short-term volatility.

Somewhere in the Middle

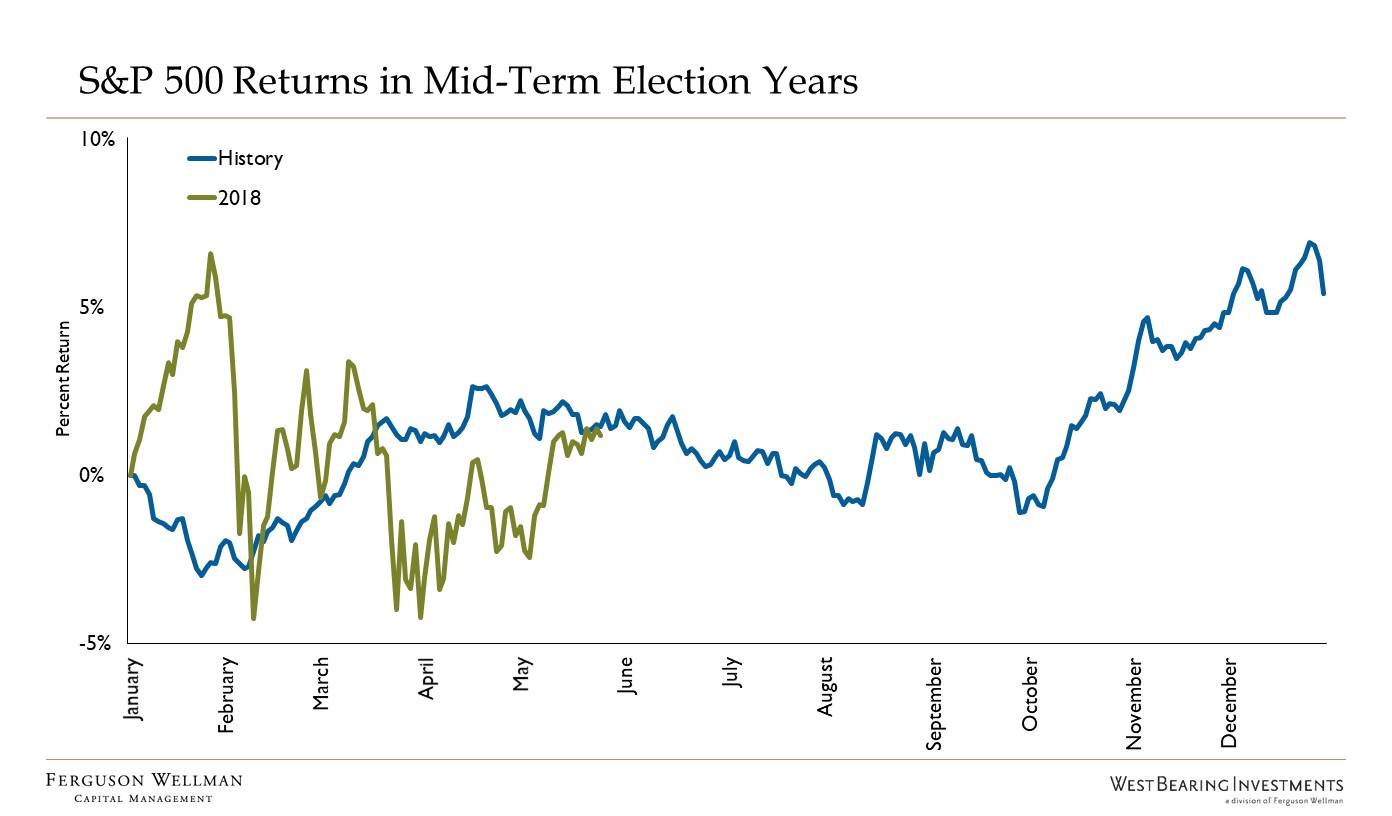

Also in bloom is primary season. We analyzed equity returns during election years.

There seems to be more uncertainty about the mid-terms than there were earlier in the year. In January, it seemed to be a foregone conclusion that Democrats would sweep both the House and Senate. However, recent polling has shown momentum slipping. This uncertainty, which usually occurs in most elections years, can result in heightened market activity. The chart below contrasts the S&P 500 during each mid-term election since 1978, with the market action thus far this year.

Source: FactSet

Source: FactSet

Looking at past data, stocks have been roughly flat through October, but as election day approaches, investors get more comfortable and stocks rally. Thus far, 2018 market price has been roughly in-line with the average mid-term year.

Say What You Will

Although the ride over the next several months may be rough, we believe that economic and corporate fundamentals continue to be strong and equity investors should remain invested. It’s virtually impossible to time the market. As such, focusing on fundamentals should “trump” the calendar.

Jason Norris, CFA, is executive vice president of research at Ferguson Wellman Capital Management.