With global growth reaccelerating, coupled with a strong and improving U.S. economy, we do not see a recession at least until 2019.

Stocks have rallied over 6 percent this year despite headlines. Investors in November bid up equities with hopes of major fiscal stimulus that has not delivered.

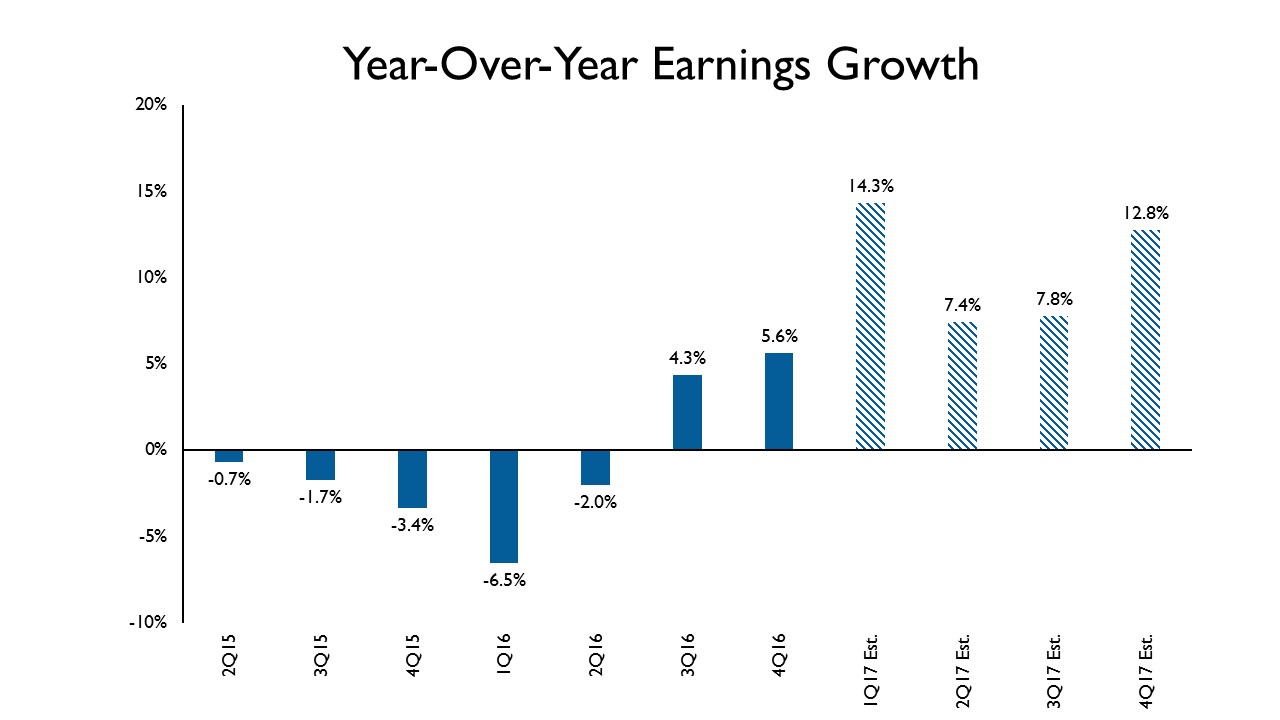

However, what has been promising are current company earnings compared to the earnings recession we have seen over the last several years. With stocks hitting all-time highs, companies had to show some earnings growth and we have now witnessed solid earnings growth in the first quarter of 2017.

With over 90 percent of S&P 500 companies reporting their first quarter earnings, year-over-year growth is coming close to 15 percent.

Source: FactSet

Source: FactSet

While the energy sector has led the way with triple-digit growth, the nominal numbers are still very small.

The two largest sectors in the index, technology and financial services, have delivered growth of 17 percent and 19 percent, respectively. If trends continue, growth in 2017 will be roughly 10 percent.

The last four years combined earnings grew a total of 13 percent, or 3 percent annualized. Can this growth justify the move we’ve already seen in equities? We believe so. In addition, historical data shows stock market rallies don’t end due to valuations or time; they end as the economy moves toward recession.

With global growth reaccelerating, coupled with a strong and improving U.S. economy, we do not see a recession at least until 2019. Thus, we continue to be constructive on equities.

Shake it Up

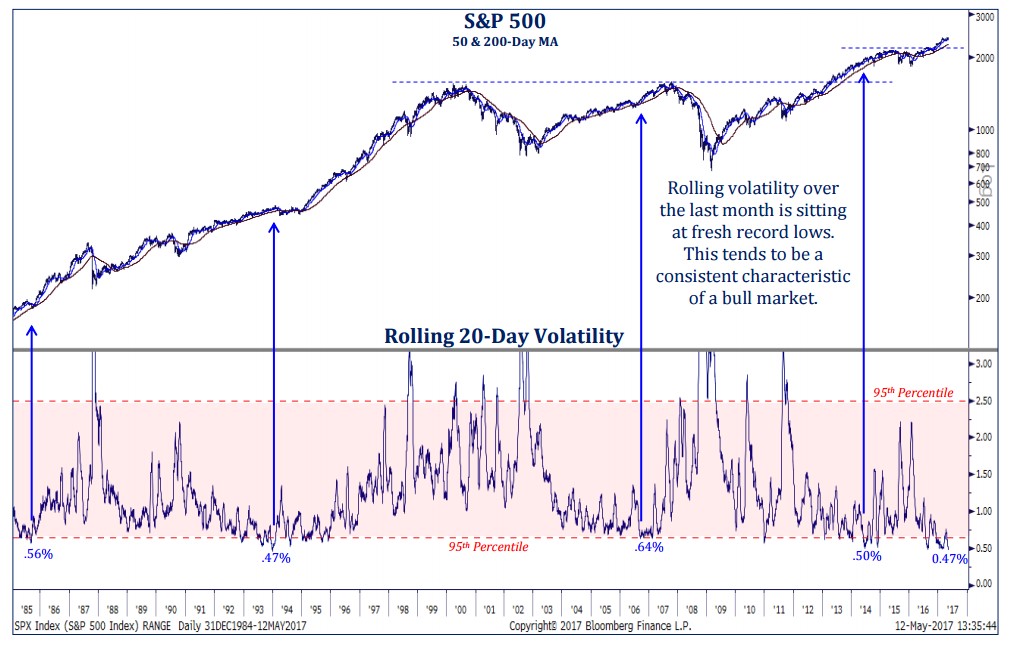

In our March blog, we focused on the lack of volatility in the equity markets and how investors have shrugged off the “headlines” coming out of Washington, D.C.

While nothing has changed on the headline front, market volatility continues to decline. However, this complacency should not be taken negatively. In fact, historically, when volatility is at record lows, stocks are in a bull market and continue to trend higher. The chart below highlights these incidences.

Source: Strategas Research

Source: Strategas Research

While we have seen a recent uptick in market volatility, it is still at a very low level. We wouldn’t be surprised if stocks tread water throughout the summer as investors digest the ramifications of the recent headlines, as well as the headwinds of seasonality.

Historically, summer is usually the weakest for equities. Longer-term, we still believe the backdrop for U.S. equities is positive.

Jason Norris, CFA, is executive vice president of research at Ferguson Wellman Capital Management. Ferguson Wellman writes a monthly financial markets blog for Oregon Business.